Temu Underprices Amazon by 20% on Anker Headphones; Alibaba Q3 Earnings: AIDC's Revenue Soars 29% to $4.5B

Latest news and analysis on China’s global e-sellers

Here’s our pick for last week’s news:

Shein's Ireland Entity Posts 68% Growth in 2023, With $8.12B in Sales

Chinese E-commerce Set to Capture 21% of Global Holiday Sales

TikTok Shop Leads Vietnam's E-Commerce Surge with 110% Revenue Growth

Temu Underprices Amazon by 20% on Anker Headphones

Huakai Yibai's Revenue on Temu Reaches $12.64M in Q3

Shenzhen-Based Thousandshores Goes Public

Alibaba Q3 Earnings: AIDC's Revenue Soars 29% to $4.5B

JD Global Sales Doubles Transaction Value and Orders During 11.11 Festival

AliExpress Names Jaime Lorente as Brand Ambassador in Spain

Shein's Ireland Entity Posts 68% Growth in 2023, With $8.12B in Sales

Shein's Ireland-registered entity, Infinite Styles Ecommerce Co, posted a 68% revenue growth in 2023, reaching €7.684 billion ($8.12 billion). After-tax profit more than doubled to $105.13 million, up from $48.39 million in 2022. Gross profit surged to $331.76 million, compared to $181.73 million the previous year.

The company paid $19.44 million in taxes, up from $6.13 million in 2022, and increased its workforce to 24 employees, with a wage bill of $5.81 million. Shein's British entity recently reported $2 billion in sales for the UK, its third-largest market after the U.S. and Germany.

Chinese E-commerce Set to Capture 21% of Global Holiday Sales

Salesforce forecasts that Temu, Shein, AliExpress, and TikTok will account for 21% of global e-commerce sales outside of China, or roughly $160 billion, this holiday season. This surge in Chinese marketplaces is one of the key global trends for some time, with six of the world's top seven e-commerce platforms being Chinese, according to Beth Ann Kaminkow. Shein's fast-fashion market share in the U.S. doubled in two years to March 2022, while Temu, which invested $21 million in Super Bowl ads, became the most downloaded app in the U.S. in the first half of 2024.

TikTok Shop Leads Vietnam's E-Commerce Surge with 110% Revenue Growth

Vietnam's e-commerce market grew 37.7% year-on-year, reaching $9.5 billion in the first nine months of 2024, according to Metric. TikTok Shop and Shopee led the charge, with revenue surging 110.6% and 11.3%, respectively. Tiki also showed improvement, bouncing back with a 38.1% increase from Q2. Chinese platforms are expanding, with Temu entering the market and 1688's iOS app now supporting Vietnamese. Although Taobao, Alibaba's domestic platform, doesn't yet support the language, it now offers shipping to Vietnam. These moves heighten competition in a market already dominated by Shopee, Lazada, and TikTok Shop.

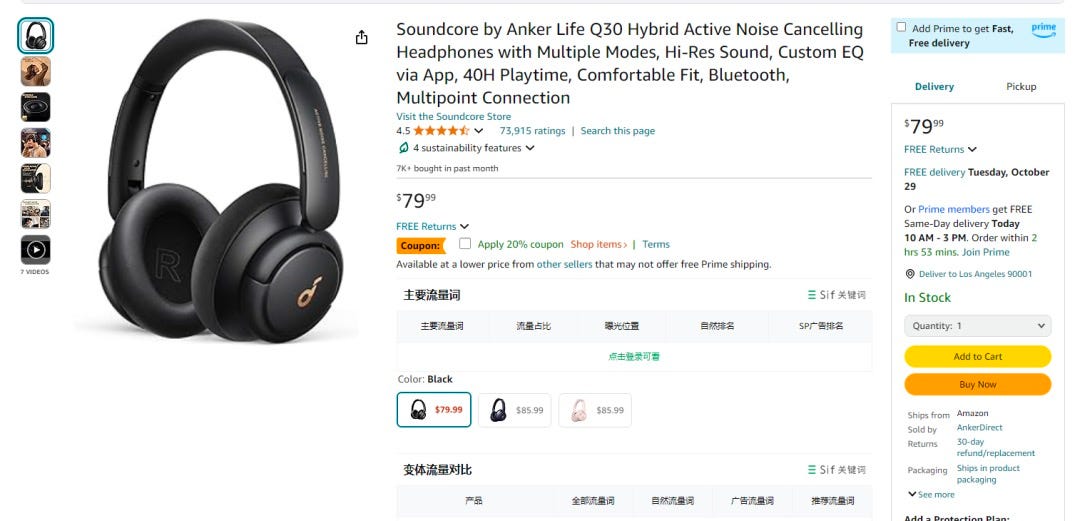

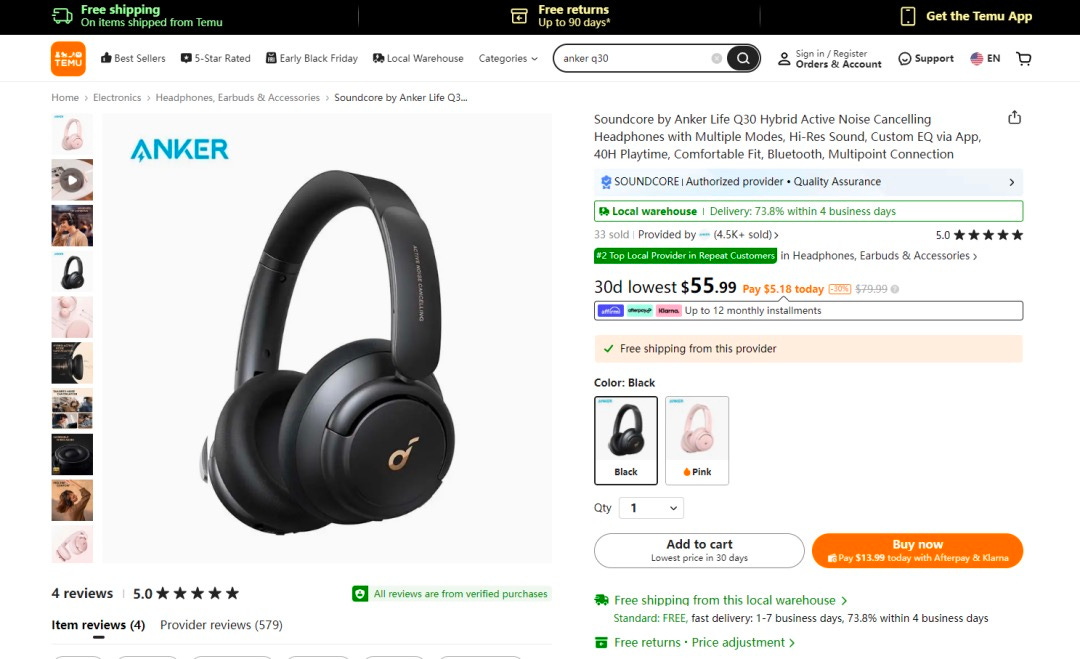

Temu Underprices Amazon by 20% on Anker Headphones

In June, Anker partnered with Temu as a semi-managed seller, which led to a noticeable pricing discrepancy. For example, an Anker over-ear headphone priced at $55.99 on Temu is listed at $79.99 on Amazon—representing a roughly 20% discount after commissions.

Temu employs a dynamic pricing model based on Amazon, offering products from U.S. or European trademarked merchants with $300,000+ in sales for six months at 75%-85% of Amazon's prices. Sellers with overseas credentials are priced at 90%, while unbranded items are set to be the lowest price online. Unlike Amazon, Temu charge no commissions or ad fees, enabling sellers to match Amazon's profits.

A July report from LatePost found that, while brands like Xiaomi and Realme on Temu offer discounts of less than 15%, top sellers such as SONGMICS Home and Dreame often cut prices by more than 30%.

Huakai Yibai's Revenue on Temu Reaches $12.64M in Q3

Shenzhen-based Huakai Yibai released its Q3 2024 financial result. For the first nine months, revenue grew 28.75% to $844.12 million, while net profit dropped 36.74% to $26.09 million. In Q3, revenue surged 47.72% year-on-year to $358.36 million, but net profit fell 40.01% to $7.56 million.

Subsidiary Yibai Network showed steady revenue growth: $234.26 million in Q1, $251.79 million in Q2, and $263.94 million in Q3, a 4.86% quarter-on-quarter increase. However, net profit declined each quarter, from $14.08 million in Q1 to $9.80 million in Q3, down 14.41% from Q2.

The growth was driven by its multi-channel strategy, with Q3 earnings of $12.64 million from Temu, $15.05 million from TikTok, and $13.94 million from Walmart. Its Easy Seller platform added 263 merchants, contributing $99.94 million.

Profit pressures stemmed from rising costs in warehousing, staffing, advertising, and management. Inventory surged 139.06% by Q3's end due to peak-season pre-stocking, while Yibai Network's storage expenses jumped 72.15% to $14.49 million.

Shenzhen-Based Thousandshores Goes Public

Shenzhen-based Thousandshores, a leading cross-border e-commerce seller, has gone public on China's National Equities Exchange and Quotations (NEEQ, also known as the New Third Board, a financing platform for small and medium-sized enterprises). The company saw steady revenue of $211.21 million in 2022 and $193.26 million in 2023, while net profits surged from $3.66 million to $13.31 million, reflecting robust profitability growth.

Founded in 2010, Thousandshores has built a portfolio of well-recognized private-label brands such as Ohuhu, Tribit, Sportneer, and iClever, which span categories like digital electronics, home and garden, and sports. The company has a strong presence on Amazon, with the platform contributing more than 90% of its revenue in 2022 and 2023. In 2023, Thousandshores generated a GMV of $178.90 million on Amazon, accounting for 99% of its total revenue. Additional earnings came from its DTC website, AliExpress, and eBay.

Alibaba Q3 Earnings: AIDC's Revenue Soars 29% to $4.5B

Alibaba Group reported a 5% year-over-year revenue increase for the quarter ending September 30, 2024, totaling $33.7 billion. Net income surged 63% to $6.2 billion. Revenue from Alibaba International Digital Commerce Group (AIDC) grew 29% year-over-year to $4.5 billion, driven by strong performance in cross-border operations, particularly AliExpress' Choice business.

During the quarter, AliExpress launched the "AliExpressDirect" model, aiming to expand product selection and improve fulfillment efficiency by leveraging local inventories. Additionally, synergies between AliExpress and Cainiao's cross-border logistics reduced average delivery times, further strengthening AliExpress' edge.

JD Global Sales Doubles Transaction Value and Orders During 11.11 Festival

JD Global Sales, JD.com's international e-commerce division, saw impressive growth during the 11.11 shopping festival, with both transaction value and order volume more than doubling year-over-year. U.S. orders surged 252%, while Singapore saw a 148% increase.

This year, JD Global expanded into Malaysia and Thailand, adding them to its "Free Shipping Zone". The move drove a 208% increase in Thailand and a 77% rise in Malaysia. Hong Kong also saw strong sales, with over 2,000 brands reporting a 100% jump. Local consumers showed strong interest in smartphones from Apple, Xiaomi, and ASUS, while vivo's latest launch pushed the brand's sales up by more than six times.

AliExpress Names Jaime Lorente as Brand Ambassador in Spain

AliExpress kicked off its global 11.11 shopping festival on November 11, unveiling Spanish actor Jaime Lorente, known for Money Heist and Elite, as its new ambassador. With over 14 million Instagram followers, Lorente's addition comes as the platform ramps up for one of its biggest annual events, offering discounts up to 80% across the platform and up to 50% on major brands. The festival has been extended through December 3.

Spain remains a key market for AliExpress, ranking just behind Amazon in a 2024 Elogia study, while CBCommerce.eu ranks it as Europe's second-largest cross-border e-commerce platform. Additionally, AliExpress boosted its UK presence through sponsorships, including a feature on BBC's Top Gear and sponsorship of Sam Tompkins' 2024 music tour.