Amazon’s Budget Store: Echoes of China’s Semi-Managed Model

From Fully-Managed to Semi-Managed Model

Introduction

Background

Timeline: From Fully-Managed to Semi-Managed Model

Fully-Managed Model

The initiative of Fully-Managed Model

What's the Fully-Managed Model

Challenges of the Fully-Managed Model

Emergence of Semi-Managed Model

Semi-Managed vs. Fully-Managed: Unleashing Transformations

Product Category

Fulfillment Efficiency

Profit Margins

Regulations

Case Study: Semi-Managed Model on Different Platforms

Shein

Temu

AliExpress

On April 16, media outlets reported that Amazon plans to launch a new section on its site dedicated to low-priced fashion and lifestyle items that will allow Chinese sellers to ship directly to U.S. Consumers.

Western analysts view this move as a strategic response to Chinese competitors like Shein and Temu. Overall, this assessment is not wrong. Amazon's choice to announce its plan in Shenzhen is quite telling. Many Western commentators argue that Amazon is copying from its China, especially in terms of low-cost strategies, which is not wrong as well.

However, from the perspective of Chinese platforms, precisely, Amazon's new low-cost store seems to be copying the Semi-Managed Model that has recently become popular among Temu, Shein, Aliexpress and so on. Initially, these Chinese marketplaces were Fully Managed, but the Semi-Managed approach has emerged. The two models are seen as key strategies for the rise of Chinese cross-border e-commerce marketplaces.

This article aims to provide a comprehensive overview of this transition and analyze the nuanced focuses of different platforms' Semi-Managed strategies.

Background

Before the advent of the Semi-Managed Model, 2023 saw a significant increase in the adoption of the Fully-Managed Model across Chinese cross-border e-commerce platforms. However, the Fully-Managed Model often led to conflicts between the interests of sellers or brands and those of the platform. Additionally, fulfillment efficiency declined as goods were shipped from China rather than from local inventories.

In response, some platforms are now focusing on engaging sellers with localized inventory abroad, giving rise to the Semi-Managed Model.

In January 2024, Alibaba's AliExpress pioneered the Semi-Managed Model, allowing sellers to retain ownership of goods, set prices, and maintain operational autonomy while the platform manages logistics fulfillment. Following this, in March, PDD's Temu launched a Semi-Managed trial in the US. In early May, Shein also chose the US as the inaugural market for its Semi-Managed Model.

Against this backdrop, this article aims to provide a comprehensive overview of this transition and analyze the nuanced focuses of different platforms' Semi-Managed strategies.

Fully-Managed Model

The initiative of Fully-Managed Model

In 2023, the Fully-Managed Model took center stage amongst cross-border e-commerce platforms. Big names like AliExpress, Temu, Lazada, Shopee, and TikTok jumped on board.

Temu led the charge, rolling out its Fully-Managed Model in September 2022. Its aggressive pricing and efficient operations quickly led to success in the US, with impressive metrics in app downloads, GMV, user acquisition, retention, and conversion rates.

This success story inspired other giants to adopt the model, sparking a sector-wide transformation.

AliExpress launched its Fully-Managed service in December 2022, offering sellers better profit margins. By April 2023, a newly funded Lazada had adopted the model. May saw Shein and TikTok Shop follow, with Shopee joining in July.

What's the Fully-Managed Model

The essence of Fully-Managed Model lies in the principle of "sellers supply goods while platforms handle the rest." This means sellers don't have to worry about sales and operations, making things a lot easier for them. It reduces their workload and cuts costs. Sellers with good supply chains but no experience in operations can really benefit by just focusing on product quality and cost. The marketplaces can then ensure better quality, logistics, and user experience. Here’s what the marketplace expects:

More Loyal Users: One-stop service means sellers rely on the platform more, boosting loyalty.

More Sales: Easier processes for sellers mean products go up for sale faster, increasing sales volume.

Useful Data: Data from Fully-Managed Model helps the platform understand market needs better, improve features, and create new services.

Better Brand: High-quality services boost the platform's brand, attracting better sellers and buyers.

Extra Income: Besides transaction fees, Fully-Managed Model can bring extra income from services like marketing and logistics.

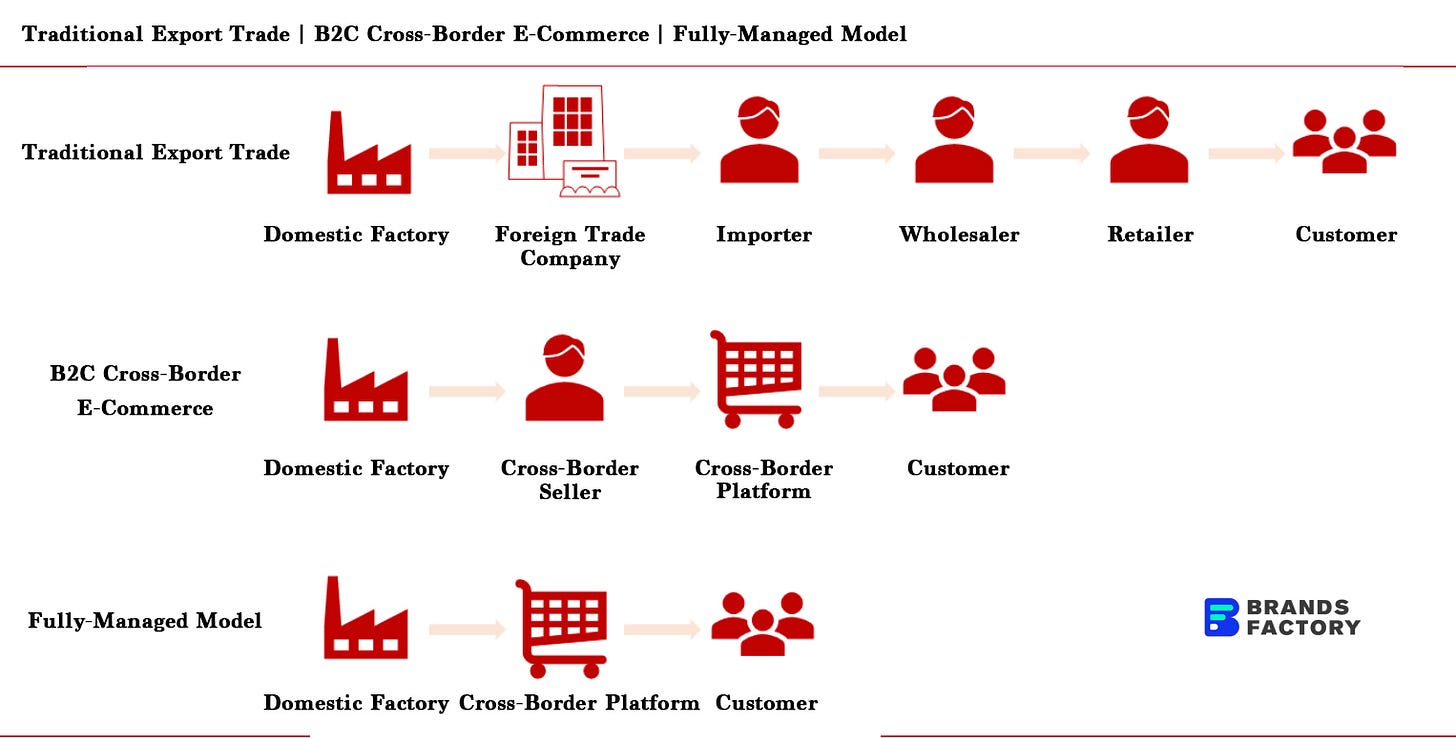

The leap from traditional trade to a Fully-Managed Model marks a major step towards simplifying transactions. Unlike the complex export systems of the past, B2C cross-border e-commerce has already streamlined processes by cutting down on intermediaries. The Fully-Managed Model, operating on an F2C (Factory to Consumer) basis, connects factories directly with consumers via platforms, enhancing distribution channels and delivering exceptional value to overseas buyers.

Challenges of the Fully-Managed Model

The Fully-Managed Model comes with significant barriers. It demands sellers maintain high product quality, strong fulfillment capabilities, and substantial financial reserves. This model is best suited for sellers with stable supply sources or factories. To succeed, sellers must consistently launch new products and ensure timely deliveries.

However, even the best sellers are not immune to replacement. Platforms will favor lower-priced sellers with similar product quality, making it tough for less competitive sellers to survive. Even successful sellers face the risk of being replaced. To avoid this, sellers need to balance costs and supply prices while continually improving supply chain efficiency, which can severely compress profits.

Moreover, there’s an inherent conflict in the Fully-Managed Model: the interests of sellers clash with those of the platform. Sellers lose pricing control, relying on the platform's bidding system for price flexibility and shouldering all inventory risks. This shifts the risk to sellers and makes the platform the dominant player, complicating the sustainability of the Fully-Managed Model.

From the platform's viewpoint, fulfillment speed in the Fully-Managed Model is still too slow. Goods are shipped directly across borders, passing through domestic warehouses, international logistics, and local delivery before reaching consumers. Even with optimized efficiency and using air freight for international transport, delivery still takes about a week.

This model also severely limits product variety. The reliance on air freight means platforms mostly stock small, lightweight items like digital accessories. High-value, bulky items, and some electronics are hard to include due to shipping costs. However, platforms need to continually expand their merchant base and product range to attract consumers. Sticking to small items only introduces another issue: the finite capacity of air freight.

Temu's Fully-Managed Model divides logistics into three stages:

Suppliers send goods to Temu's domestic warehouses.

The platform manages cross-border shipping, mainly by air.

Third-party carriers like UPS and USPS handle the final delivery.

Shipping from China means longer delivery times. Temu says standard free shipping takes 8-12 days, and expedited shipping takes 5-9 days.

Amazon, using local warehouses and a robust logistics network, delivers in the US within 2-3 days. This efficiency helps Amazon overcome time and variety challenges, with SKUs reaching 30-60 million, ten times more than Temu. Nearly half of Amazon's best-sellers come from Chinese sellers.

Emergence of Semi-Managed Model

Chinese platforms have recognized the significant gap in fulfillment efficiency compared to Amazon. With its FBA warehouses, Amazon is closer to consumers and delivers faster. This high logistics efficiency keeps competitors behind, giving Amazon a market share six times that of second-place Walmart. For large or heavy items, overseas warehouses also reduce shipping costs.

Seeing Amazon's success, cross-border e-commerce platforms are focusing on improving their overseas warehousing and fulfillment. Some platforms even target sellers who stock products locally, leading to the emergence of the semi-managed model.

In January, AliExpress introduced Semi-Managed fulfillment, where sellers retain control over inventory, pricing, and operations, while the platform handles logistics. Products under both Semi-Managed and Fully-Managed Models appear together in the Choice channel. Following this, in March, Temu launched a Semi-Managed pilot in the US, and Shein chose the US for its first Semi-Managed rollout in early May.

Semi-Managed vs. Fully-Managed: Unleashing Transformations

Unlike the all-in-one approach of Fully-Managed services, the Semi-Managed Model gives sellers control over some logistics and operations. This shift results in significant changes in three key areas:

Product Category

After launching the Semi-Managed Model, bulky items such as home decor and lighting began to quickly join AliExpress. Temu also announced a call for all categories, including high-difficulty products like food. The Semi-Managed Model marks the platform's step into the era of brand operations. In the past, the platform mainly attracted white-label sellers. However, with the introduction of Semi-Managed Model, which respects brand sellers' pricing and marketing autonomy, it is likely to attract more brand sellers. This will help the platform offer a richer variety of products and SKUs.

Fulfillment Efficiency

For instance, Temu's Semi-Managed Model, which focuses on local shipping for items not eligible for direct cross-border delivery, cuts fulfillment time from 7-14 days to 4-9 days. In Shein's Fully-Managed Model, cross-border sellers send their products to a designated domestic warehouse, and Shein handles the overseas shipping with its logistics partners, managing final-mile delivery. In contrast, the Semi-Managed Model allows sellers to use their preferred warehouses and logistics services, making the process more flexible and reducing the platform's workload.

Profit Margins

This new approach empowers merchants to effectively manage their gross and cost structures. Leading brands typically uphold their own DTC websites and offline retail stores, prioritizing control over promotional initiatives and pricing strategies.

Regulations

Western countries' regulatory policies on Chinese platforms have also driven the move to Semi-Managed Models. While Shein and Temu's success in overseas markets is due to their own efforts, it also depends on the tax exemptions for cheap parcels in the U.S. and Europe. However, this policy may be abolished soon. Last June, the U.S. Congress introduced two bills to eliminate this tax exemption. Recently, lawmakers targeted it again. The EU is also planning comprehensive reforms to end these tax breaks. If these new rules come into effect, it will severely impact cross-border direct shipping. Fully-Managed costs will rise, affecting profits. To manage future risks, platforms must accelerate local warehousing and distribution, making the Semi-Managed Model a wise choice.

Semi-Managed Model on Different Platforms

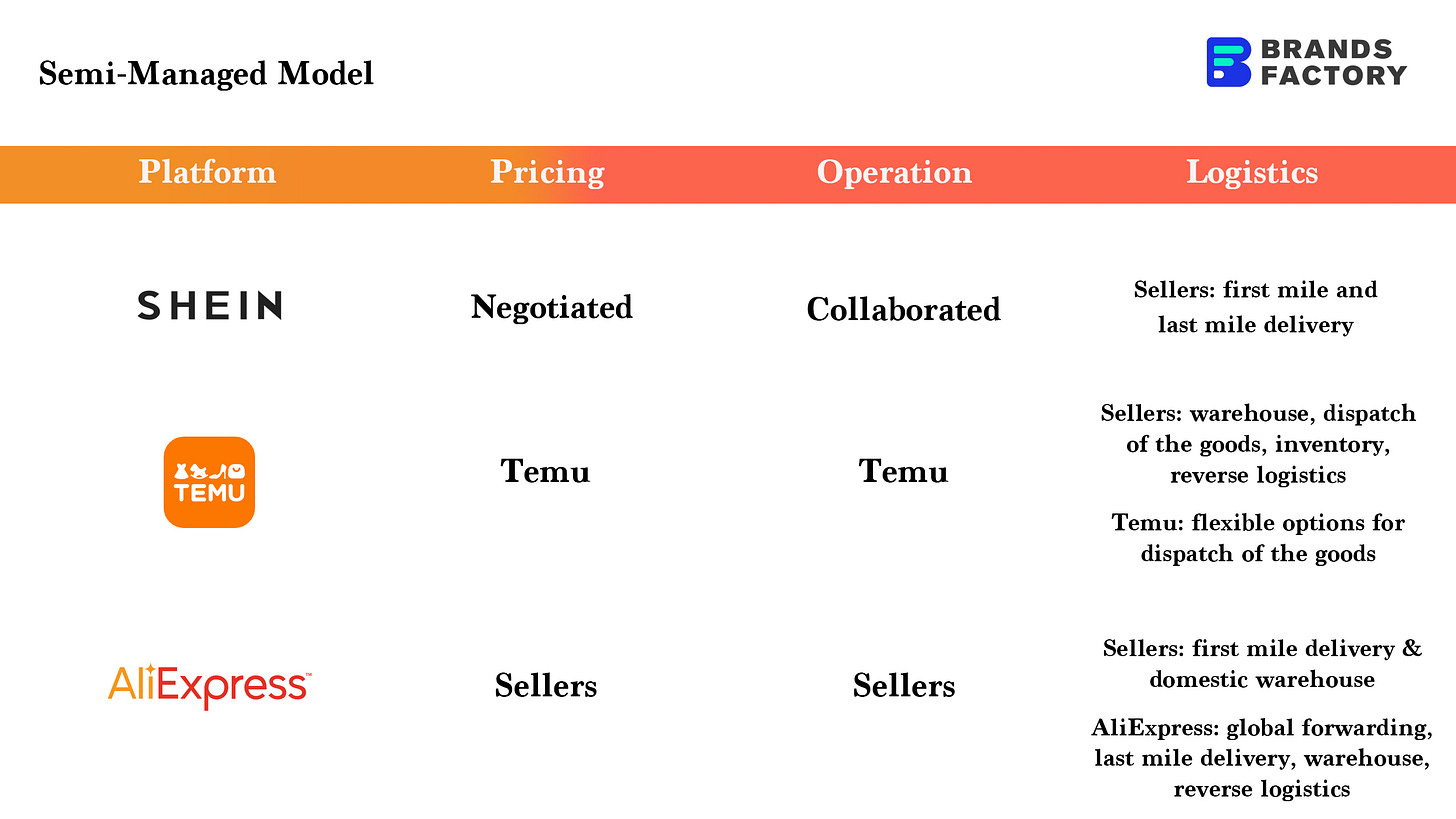

In 2024, even though all platforms have rolled out Semi-Managed Models, they’re not all the same. Temu and Shein switched from Fully-Managed to Semi-Managed by picking sellers with local inventory to ship orders. AliExpress, on the other hand, gives sellers more control over their operations but still handles warehousing and shipping.

AliExpress

As one of Alibaba's earliest B2C cross-border e-commerce platforms, AliExpress boasts a vast network of third-party sellers and rich product resources. These sellers are highly skilled in e-commerce operations. Consequently, AliExpress's Semi-Managed Model stands out by handling warehousing, logistics, and after-sales services, especially assisting merchants without overseas logistics capabilities.

Supported by Cainiao Logistics, AliExpress can improve delivery speeds by about nine days without increasing costs. However, merchants retain control over operations and pricing, allowing them to increase profit margins and boost order volumes.

Temu

Temu's Semi-Managed Model aims to attract sellers who have stock in local markets. This approach enhances the platform's logistics efficiency and product variety. These sellers handle their own shipping and logistics, while Temu controls product selection and pricing, similar to the Fully-Managed Model. This setup is particularly appealing to sellers with excess inventory who need to clear stock. By eliminating domestic shipping and logistics, Temu can directly compete with Amazon and even lure some of its sellers, potentially attracting U.S. sellers to join as well.

Shein

Shein's Semi-Managed Model is much like Temu's, focusing on sellers with local stock. But Shein goes a step further with "negotiated pricing," making it more attractive to not just those with excess inventory, but also curated sellers, multi-channel operators, and brands.