China's Global E-Commerce in 2024

How 2024 reshaped China's cross-border e-commerce?

Amazon's dominance in e-commerce is once again being tested.

A decade ago, it faced competition from eBay, Walmart, and Google. Now, China's "Four Dragons"—Shein, TikTok Shop, Temu, and AliExpress—are mounting the challenge.

Despite its leadership in logistics and technology, Amazon's market share is steadily shrinking. Temu, with a business model that closely resembles Amazon's, has emerged as a serious low-cost rival. In November, Amazon responded by launching Haul, a budget marketplace targeting price-sensitive shoppers.

In 2024, Amazon returned to its roots under mounting competitive pressure, while low-price e-commerce faced stricter global regulations. Meanwhile, the era of "stocking mode"—a strategy of selling broadly across multiple categories—appears to have passed into history.

Here is a look at how 2024 reshaped China's cross-border e-commerce.

Amazon vs. Temu: The Fight for Low-Cost E-Commerce

Amazon's rivalry with Temu escalated in 2024 as the Chinese platform closed the gap on Amazon's market dominance. By August, Temu's global user base had grown to 91% of Amazon's, with projections indicating it could surpass Amazon by year-end. Temu's surge in popularity was further validated in October, when it became the second most-visited e-commerce site globally and the top free app on the U.S. Apple App Store.

Temu's semi-managed logistics model, launched in March, has been key to its rapid growth. This model, which integrates with sellers' existing systems, provides faster delivery times and more product variety, attracting many Amazon sellers. By October, more than 60% of China's top Amazon sellers had transitioned to Temu.

Amazon, feeling the heat, introduced Haul—a budget marketplace focused on sub-$20 items—to compete directly with Temu. Haul's initial rollout was limited to 300 invited sellers, but the company plans to expand access based on feedback.

Meanwhile, speculation is mounting that Temu is exploring a third-party platform model, a significant evolution that could further reshape e-commerce.

The competition has also sparked controversies. In October, Anker briefly removed its products from Temu, leading to rumors that Amazon was pressuring sellers to choose between platforms. While Amazon denied these claims and Anker restored some listings, the incident reflects the growing tension between the two e-commerce giants.

The Rise of Semi-Managed Model

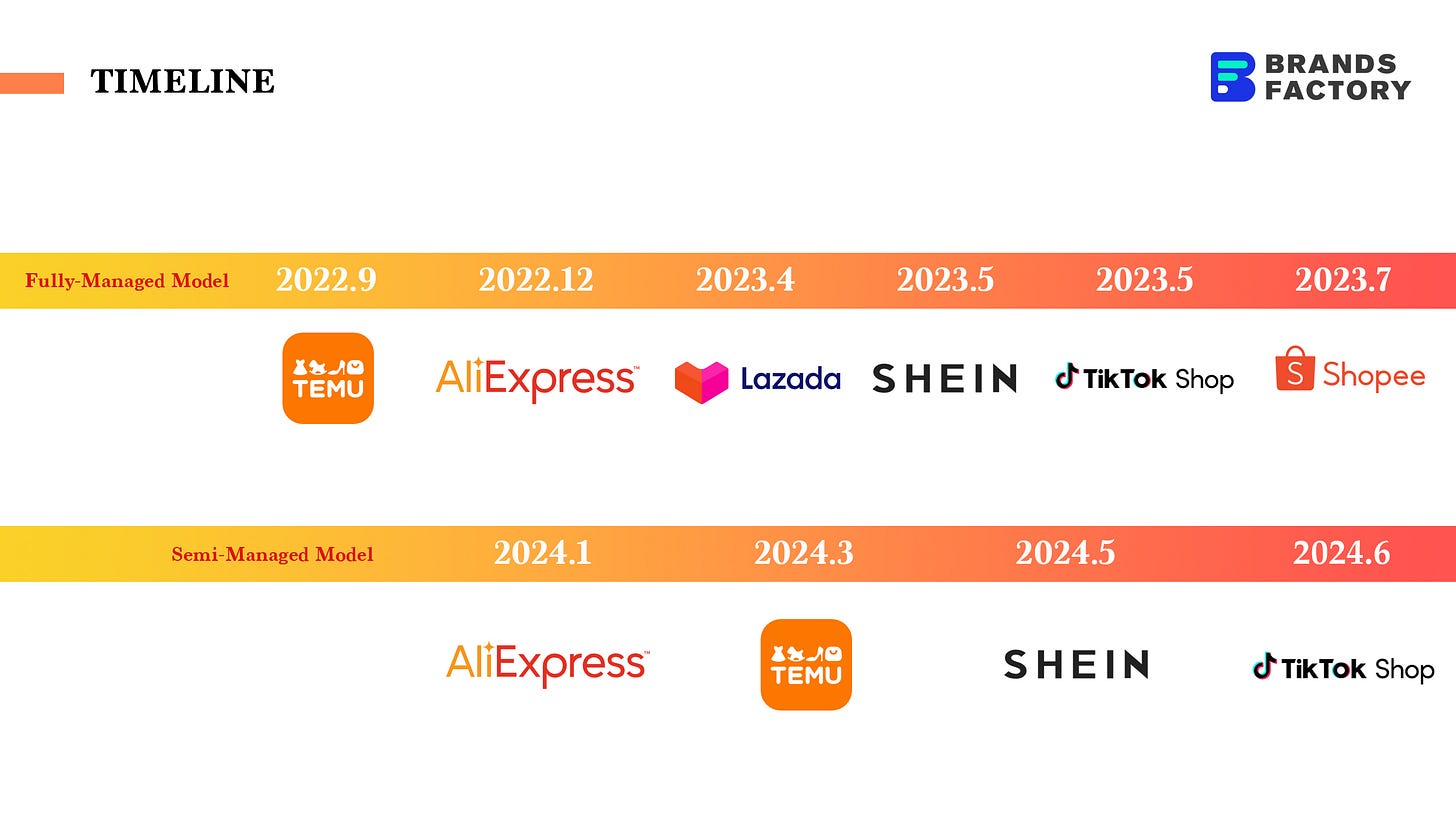

The semi-managed model reshaped cross-border e-commerce in 2024, as platforms like Temu, Shein, AliExpress, and TikTok Shop adopted this hybrid logistics approach to address the shortcomings of fully-managed systems.

Fully-managed shipping has long relied on small-package logistics, limiting order values and the diversity of products offered. The semi-managed model, by contrast, integrates with sellers' logistics systems to reduce delivery times from two weeks to one and expand into categories such as food, books, and large home goods. Temu has gone so far as to encourage sellers to use Amazon-branded packaging for shipments, reinforcing its message of "lower prices, the same as Amazon."

The benefits have been significant. Temu became Sailvan Times' third-largest revenue source in the first half of 2024, generating RMB 60.63 million (USD 8.27 million). Other platforms, such as AliExpress, have also seen success, with 20,000 sellers doubling their orders within just 100 days of adopting the model.

In October, Temu overhauled its operations to enhance its semi-managed business. Recruitment teams were reorganized by product category and integrated with buyer teams to streamline decision-making. Meanwhile, English-language training for staff accelerated as Temu sought to expand its global footprint.

This innovative approach is spreading beyond cross-border e-commerce. Domestic giants like Taobao, Kuaishou, and Ele.me are launching similar models, with Kuaishou Select debuting in March and Ele.me rolling out its semi-managed service in April. The shift signals an industry-wide pivot toward faster, more efficient logistics.

Trade Headwinds

China's e-commerce giants—Shein, TikTok Shop, Temu, and AliExpress—are facing increasing regulatory pressure in 2024 as governments worldwide target low-cost imports. Known for disrupting traditional retail channels, these platforms now face stricter rules aimed at leveling the playing field.

The U.S. has tightened its T86 clearance rules and is considering lowering the $800 duty-free threshold for imports. Former President Trump has also advocated for higher tariffs on Chinese goods, including a proposed 60% tariff on wood products. Meanwhile, countries like Brazil, Malaysia, and South Africa have introduced new VAT policies, driving up costs for Chinese exporters.

In response, Chinese companies are pushing to establish overseas manufacturing hubs. New R&D centers and factories have been set up in Southeast Asia, Africa, Europe, and the Americas, enabling firms to comply with local regulations, reduce tariffs, and adapt products to local preferences.

By diversifying their supply chains and partnering with local suppliers, Chinese firms are trying to mitigate trade risks.

E-Commerce Adapts as "Stocking Mode" Fades

The "stocking mode" strategy—selling low-cost goods across broad categories—once defined cross-border e-commerce. But in 2024, the model is fading. Tightened platform rules and shifting consumer demands have pushed sellers to focus on brand building instead.

Shenzhen's "Big Four"—AuGroup, Tomtop, Sailvan Times, and YOUKESHU—made millions two decades ago with this strategy. Now, Chinese brands are innovating to lead global markets in robotic vacuums, action cameras, and smart kitchen appliances. Products like air fryers and coffee machines have become household staples in Europe and the U.S.

Content-driven e-commerce is powering this shift. Anker, a standout brand, built early success by creating professional visuals and leveraging social media. TikTok Shop has further enabled small businesses to use short videos and live streams to engage with consumers, creating authentic shopping experiences.

As traditional advertising wanes, video platforms like TikTok are reshaping how brands connect with audiences. Advances in AI and big data are fueling this content revolution, cementing it as the future of e-commerce.

Sellers Diversify Beyond Amazon

After years of rapid growth in a volatile market, cross-border e-commerce sellers are pivoting to multi-channel strategies to ensure sustainable development. Dependency on Amazon and other major platforms is increasingly seen as risky, prompting sellers to diversify their sales channels.

Regional platforms like Ozon in Russia, OTTO in Germany, and Allegro in Central and Eastern Europe are gaining traction, offering sellers new opportunities to expand while reducing exposure to platform-specific policies and competition. Offline channels are also part of the mix, with brands forging partnerships with local retailers to increase visibility and market reach.

Amazon's Vendor Central (VC) program, however, remains an important revenue stream for some sellers, allowing them to supply products directly to Amazon and access additional traffic and resources. Top sellers like Vesync and Ziel Home have demonstrated the profitability of this model, balancing it with broader diversification efforts.

Over the next few years, stability will be a driving priority for the industry. Whether through DTC websites, emerging platforms, or offline strategies, sellers are seeking ways to reduce risk while maintaining competitiveness.