Govee's Rise: Engineered at Anker, Exploding on Amazon

Govee's Glow-Up: Born at Anker, Booming on Amazon

When Anker was gearing up for its IPO in 2017, then-CTO Wu Wenlong took a calculated risk. He left the company to start Govee in Shenzhen, focusing on the often-overlooked lighting industry. A year later, Govee launched on Amazon in the U.S., achieving 4 billion RMB in annual sales, driven by its RGB light strips.

Fast forward to May 2025: Govee is in pre-IPO mode, with plans to go public. Anker, far from viewing Wu as a rival, backed him with 40 million RMB (about $5.6 million) in 2021. Industry insiders credit Wu’s relationship with Anker for accelerating Govee’s rise on Amazon.

Wu’s strategy capitalized on a gap in the market. While China produces 90% of the world’s LEDs, few companies embraced IoT-enabled products. Wu leveraged his resources and e-commerce expertise to dominate a market with little competition.

From Anker to Govee

Govee emerged as an ambitious project by Wu Wenlong, a co-founder and former CTO of Anker Innovations. Wu’s departure from Anker in early 2017, just six months after the company filed for its IPO, marked a strategic pivot towards the smart RGB lighting market. Building on his experience at Anker and leveraging his significant equity stake, Wu launched Govee in Shenzhen.

Wu’s position as a founding member of Anker gave him an unparalleled advantage. By 2020, when Anker went public, Wu had accumulated significant wealth and experience. Over the next three years, he sold 247 million RMB (about $34 million) worth of Anker shares, reducing his stake from 5.05% to 4.19% as of March 2025. Despite these reductions, Wu remains Anker’s fourth-largest shareholder, maintaining his influence within the company.

Anker’s relationship with Wu extended beyond his exit. In 2021, the company invested 40 million RMB (about $5.6 million) in Govee, acquiring a 1.257% stake. This strategic move was part of Anker’s broader diversification plan and reflected its confidence in Wu’s ability to navigate the emerging smart lighting market.

Govee’s growth trajectory has been nothing short of remarkable. The brand introduced its first music-sync RGB light strip in 2018, which quickly became a bestseller on Amazon.

By 2019, the company had generated 422 million RMB (about $58.7 million) in revenue, and by 2020, its sales surpassed $200 million. However, profitability lagged behind Govee’s top-line growth, as the market for lighting products was still viewed as less innovative compared to other smart devices like speakers and home appliances.

Small Lights, Big Business

In the competitive smart home market, it’s unusual for a brand to dominate Amazon with a product as seemingly niche as light strips. Yet Govee has done just that. According to Statista, the smart home sector reached $31.2 billion in 2017, growing over 25% annually, with North America leading the charge.

While most brands focused on popular categories like smart speakers and robot vacuums, light strips were largely ignored—until Govee entered the scene.

“Initially, no one thought light strips had real potential, but Govee’s innovative designs and savvy channel strategy changed the game,” said an industry insider.

Govee's breakout moment came in 2018 with the launch of its H601X music-sync RGB light strip. Within three years, it became the top-selling Alexa-compatible smart LED strip on Amazon. Crucially, Govee didn’t position itself in traditional lighting but firmly within the IoT space.

Today, Govee’s parent company, runs two main product lines. The flagship Govee brand offers TV backlights, smart lamps, projectors, and devices tailored for everyday living, while the 2021-launched GoveeLife line focuses on smart small appliances like countertop ice makers and humidifiers.

Govee’s products, priced between $20 and $490, combine decorative lighting with AI, smart controls, and sensor connectivity. With over 870 patents, Govee’s innovations include 16 million customizable colors and music-sync features, emphasizing personalization and interactivity.

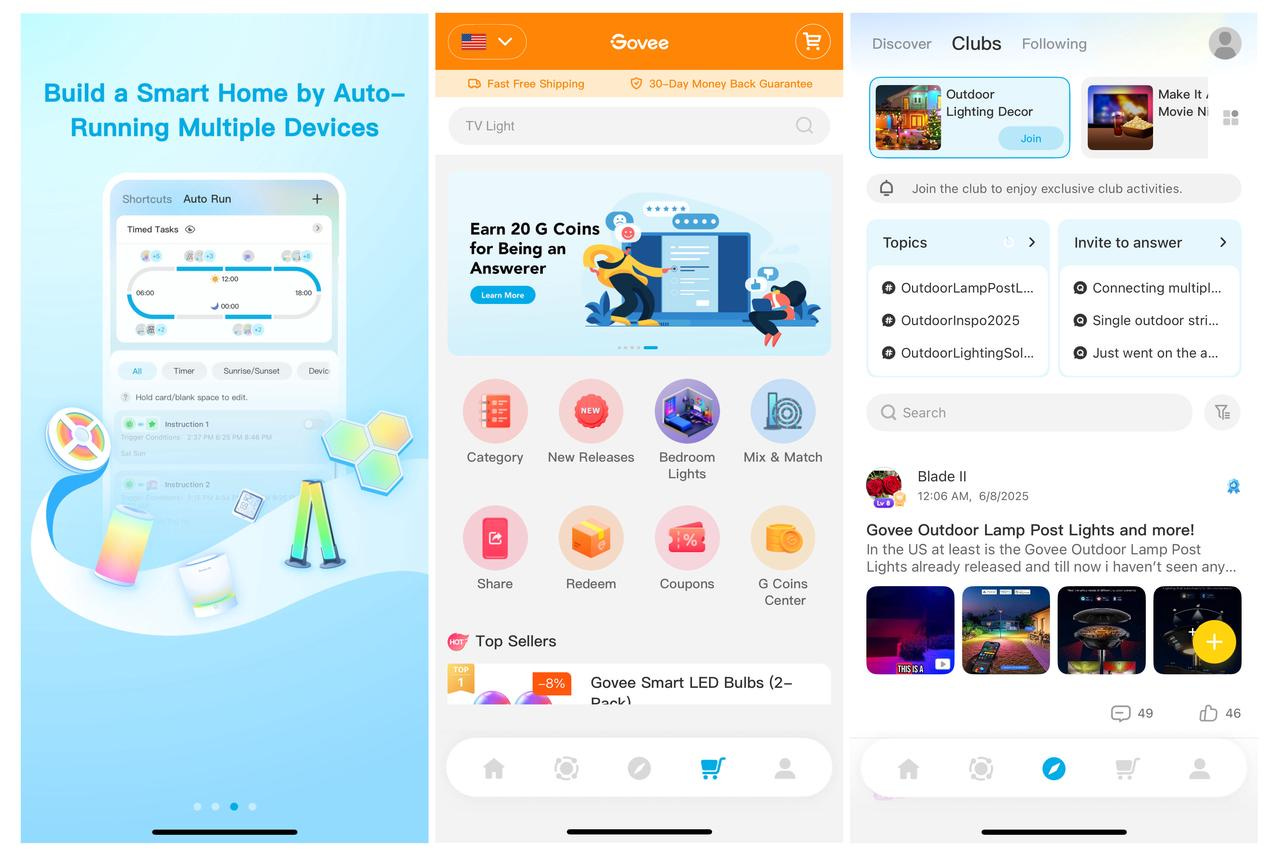

The company’s proprietary Govee Home App ties its ecosystem together, allowing users to sync lights with music, games, or videos, and customize settings in real time. The app, which had over 30 million users by December 2024, also serves as a forum for customer feedback. “Our app is a constant work in progress,” said one executive, highlighting OTA updates that improve user experience.

Initially without its own factories, Govee rapidly scaled production as demand grew. It now operates three plants: two in Dongguan for LED strips and one in Zhongshan specializing in complex fixtures like outdoor lamps.

“Ambient lighting may not be essential, but strong holiday traditions in Europe and the U.S. boost demand for home decor,” said an insider.

Govee’s success mirrors Anker’s playbook: dominate Amazon before expanding to platforms like eBay, Walmart, and TikTok. On Amazon, Govee posted consistent 300% annual growth for three consecutive years. One LED strip alone generates $12 million in monthly sales, with several products topping Amazon’s Best Seller charts.

Outside Amazon, Govee’s website attracts 1.6 million monthly visits, with nearly 40% of traffic direct and strong organic (33.06%) and paid search (16.33%) performance, according to SimilarWeb.

The brand has also leaned on strategic co-branding. A partnership with Dune: Part Two in 2023 resulted in a smart TV backlight strip that mirrored the film’s glow, selling over 33,000 units and generating $3.58 million in six months.

Collaborations with Aquaman and Pantone further cemented Govee’s reputation, driving app engagement and retail sales.

By creating viral content and fostering a lifestyle around its products, Govee has struck a chord with Gen Z. “It’s not just about lighting rooms—it’s about setting moods and reflecting personalities,” said an insider.

Govee’s story highlights the untapped potential in niche global markets, offering lessons for both large and mid-sized players.