How Chinese Sellers Are Riding America's Cannabis Boom?

Cannabis Lighting: Chinese Competitors & Profit Struggles

In recent years, the marijuana industry has garnered significant attention from investors, suppliers, and researchers. The legal US retail market for cannabis was valued at $38 billion in 2024 and is projected to reach $57 billion by 2028. This growth is expected to be driven by expanding legalization efforts and evolving policies surrounding the cannabis sector. The industry's rapid expansion has also had a global economic impact, with Chinese manufacturers emerging as key players in the U.S. cannabis market. While American companies primarily focus on cultivation, Chinese firms dominate the supply chain for essential growing equipment, such as LED lights and advanced grow tents.

A casual browse for plant grow lights on Amazon highlights this emerging trend—an influx of reviews showcasing photos of dimly lit tents illuminated by deep red and purple LEDs, nurturing cannabis plants. These advanced technologies have revolutionized indoor cultivation, with grow tents providing both discretion and LED lighting that optimize plant growth.

In 2021, Wei Zhe, the founder of Vision Knight Capital, highlighted a Chinese grow light manufacturer generating 40 million RMB ($5.52 million) in monthly profits.

What was once a niche market, cannabis grow lights have gained traction among many Chinese cross-border brands, who have shifted their focus away from conventional plant lighting to meet the rising global demand. According to Research Nester (October 2024), the plant grow light market is expected to reach $2.87 billion this year, with projections soaring to $34.85 billion by 2037, driven by a 21.4% CAGR from 2025 onward.

Chinese LED Makers Bet on Cannabis

Cannabis falls into two categories: industrial hemp and recreational marijuana, distinguished by their THC content. While industrial hemp thrives in natural light, recreational marijuana cultivation depends on grow lights to enhance potency and yield.

As regulations ease and profitability rises, more cultivators are entering the market, driving demand for advanced indoor cultivation technologies.

Chinese LED manufacturers, once focused on traditional horticulture, such as Shanghai-based SINOWELL, Shenzhen's Mars Hydro, and the recent UPSHINE have adapted to this growing sector, establishing a strong foothold by offering cost-effective and increasingly sophisticated lighting solutions.

SINOWELL: From Greenhouses to Cannabis Smart Systems

Founded in 2009, Shanghai-based SINOWELL initially produced greenhouse lighting. By 2014, it discovered its products were being widely used for cannabis cultivation abroad and pivoted to cross-border B2C, launching VIVOSUN. With competitive pricing and strong products, SINOWELL built a loyal customer base, one Amazon reviewer even noted, "I paid over $600 for a Dutch tent, but SINOWELL's version was just over $100 and even bigger."

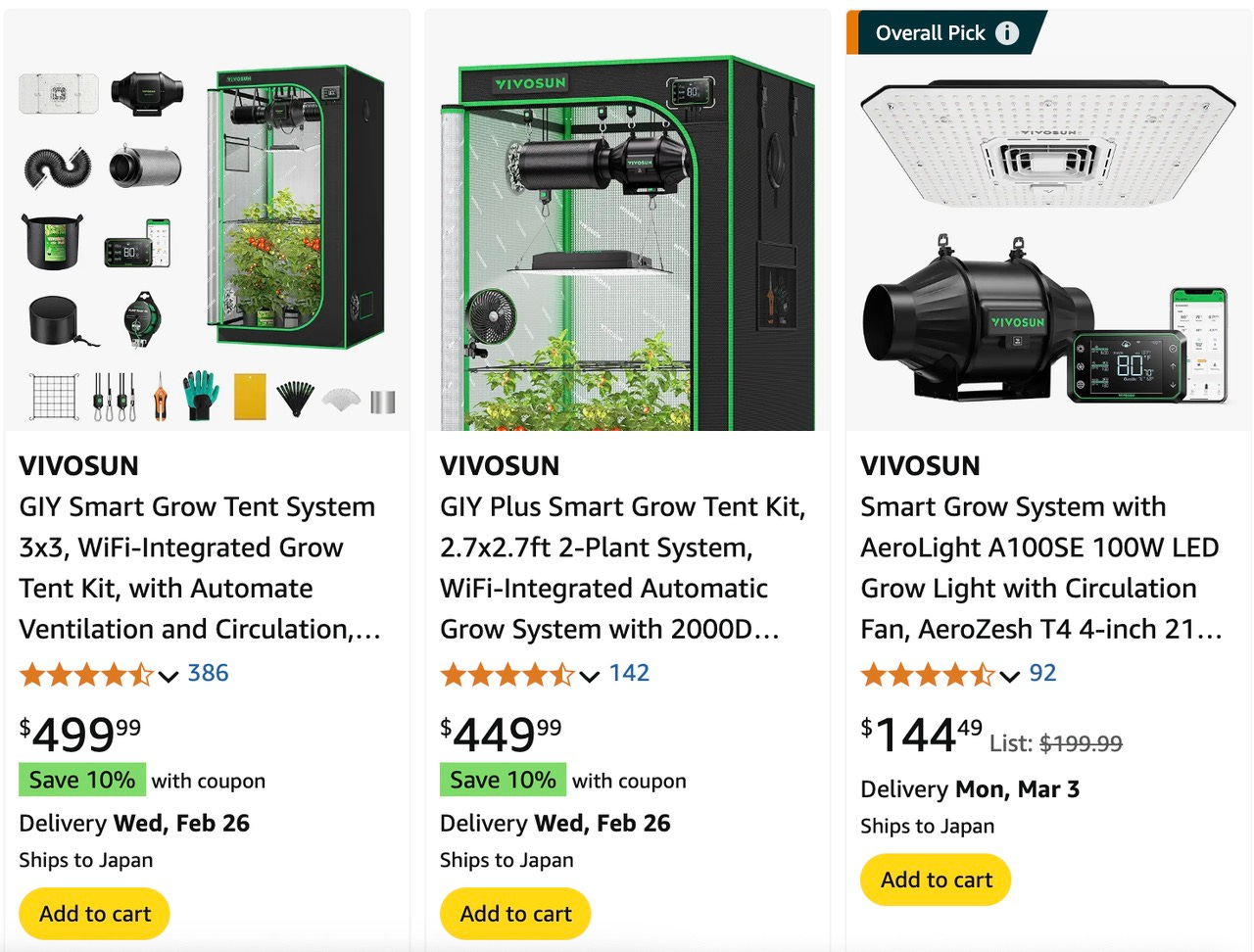

In 2022, SINOWELL introduced the Smart Grow System, an IoT-powered network of grow lights, fans, and climate controls, all manageable via smartphone. By 2023, it launched the VGrow Smart Grow Box, further driving its expansion. Priced between $300 and $1,000, the new product features automated climate control, CO2 monitoring, and data-driven optimization.

Mars Hydro: Betting on Smart Lighting Shenzhen-based

Also founded in 2009, Mars Hydro initially focused on intelligent LED production before transitioning to cannabis cultivation equipment. By 2015, it introduced the Spider Farmer brand, which quickly gained popularity among cannabis growers in North America and Europe. One of its flagship products, the SF1000 grow light ($109), sold over 900 units in a month on Amazon.

In addition to its success in consumer grow lights, Mars Hydro has expanded into IoT-enabled cultivation technology for both home and commercial growers under the brand Mars Hydro. Its 730W FC6500 LED, known for its high efficiency (PPF 2182 µmol/s, PPE 2.9 µmol/J) and smart remote control capabilities, is designed to meet the needs of tech-savvy cultivators.

UPSHINE: Expanding Beyond China Shenzhen-based

Founded in 2007, UPSHINE, a key player in commercial and industrial LED lighting, has seen plant lighting revenue surge 145% to about $6.94 million in 2023, outpacing its other divisions.

In July 2023, UPSHINE went public on the Shenzhen Stock Exchange, raising $184 million, surpassing its initial target. To mitigate North American tariffs, the company established a Vietnam-based manufacturing facility in 2022, preparing to expand production as demand grows.

China's Price War

However, the rapid surge in supply has turned the once-profitable cannabis lighting market into a fiercely competitive battleground. Since 2021, intensifying price competition has eroded profit margins, forcing companies to rethink their strategies. "The market is saturated, and sales are declining," noted a B2B seller whose annual revenue still reaches tens of millions, yet profit margins have shrunk to 15%.

The long lifespan of grow lights, typically around three years, further limits repeat sales. "The consumer base isn't expanding fast enough to absorb the supply surge," he added. A lack of differentiation has also weakened pricing power, making it difficult for companies to stand out. "There's no real innovation—just copy-paste tactics," he said. "Chinese firms excel at driving industries into margin-free competition."

The impact of this intense competition is becoming increasingly evident. In 2024, UPSHINE's gross margins in the Americas fell to 29.8%, continuing a volatile downward trend.

Even Hydrofarm Holdings Group Inc., once a leader in the high-end segment, is struggling. In August 2024, the Pennsylvania-based firm reported a $23.5 million loss for Q2, pushing its total losses past $36 million. With sales declining 13% year-over-year, the strain of oversupply continues to weigh heavily on the cannabis sector.

Price remains the primary battleground in this competitive market. SINOWELL's VIVOSUN grow tent entered at just $100, drastically undercutting premium Dutch brand Gavita's $600 model. Some budget grow tents are now selling for under $50, further intensifying the price war.

As the industry faces an ongoing reset, companies must adapt quickly. With technology evolving faster than costs can decline, only the most agile players will survive in this increasingly cutthroat environment. Is the cannabis industry here to stay, or will it succumb to the pressures of oversupply and shrinking margins?