Inside Amazon Discount Store – What We Know So Far

Amazon vs. Temu: The Battle for Bargain Hunters is Heating Up

In late June, Amazon held a private meeting with select merchants at the Raffles Hotel in Shenzhen, quietly unveiling its Discount Store to fend off competition from Temu. Months later, the store's progress and launch date remain unclear.

Insiders from the industry indicate that Amazon has been steadily preparing for the project, but only a small number of sellers were invited for the first phase, leaving little buzz in the market.

According to Brands Factory, some sellers have already begun listing products, primarily in categories like fashion, home, and lifestyle. The store is expected to go live as early as November, under its new name: Low-Cost Store.

Low-Cost Store

At a recent seller event in China, Amazon brought up the opening date for its Discount Store again. According to Brands Factory, the store hasn't officially started selling yet, but some sellers have already listed products and shipped them to Amazon's warehouse in Dongguan. "It might go live in November, but it probably won't fully open until next year," one seller said.

Mila, a seller who's already part of the Low-Price Store, said, "We run more than a dozen stores, but only one got one invitation from an Amazon manager, which was sent to our registration email." Her invited store mainly sells affordable kitchen products—small items that fit Amazon's previous rules of being under a pound in weight or smaller than 14×8×5 inches.

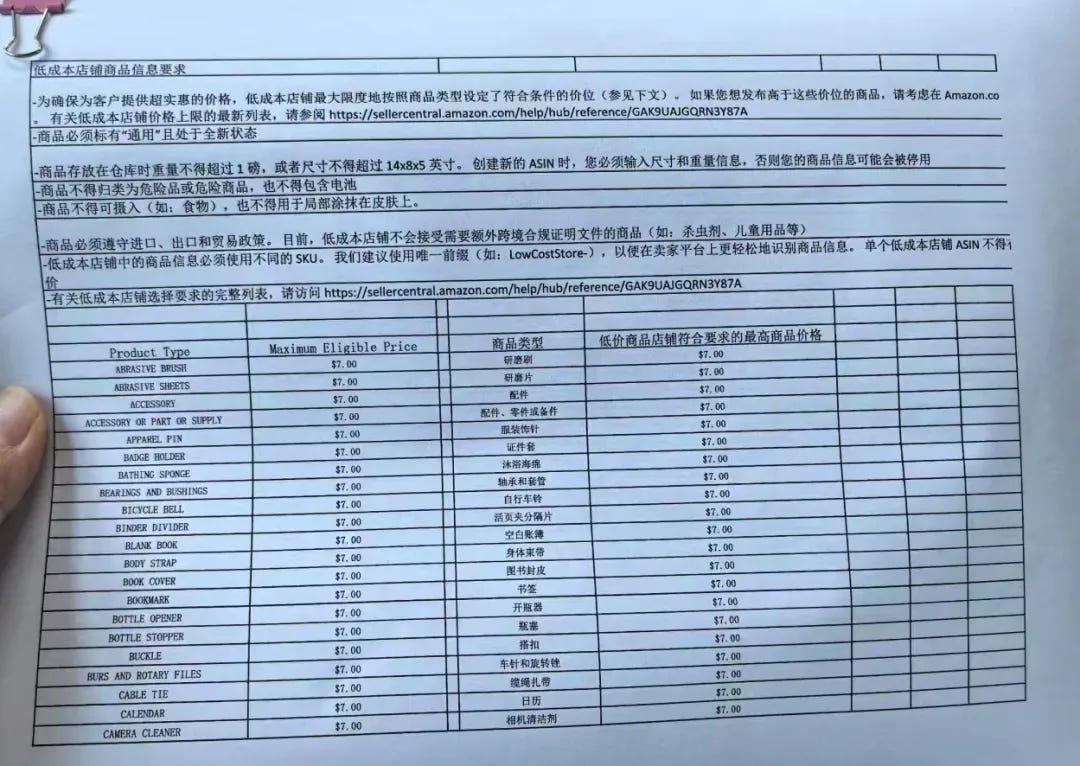

From the documents obtained by Brands Factory, it became clear that Amazon now refers to the stores within its Low-Price initiative as Low-Cost Stores. While Amazon does not directly intervene in the pricing autonomy of its merchants, it has imposed strict maximum price caps for various product categories. The price list is meticulously detailed, setting the most appropriate price limits for each item type.

For instance, the maximum price for items like clothing pins, notebooks and bath sponges is set at $7. Categories such as jewelry boxes, lint removers, magnifying glasses and valves are capped at $9. In a previous June announcement, Amazon had stated that all Low-Price Store products should be priced under $20.

Amazon's also made it clear that products in the Low-Cost Stores need to have different SKUs and suggested that sellers use a unique prefix, like Lowcoststore-, to make it easier to spot those products. This is because sellers will be managing their Low-Cost Shop items through the same backend as their main store, and the prefix helps avoid mistakes.

"To encourage sellers, Amazon has rolled out some perks, saying that the Low-Price Store is about to launch, and products warehoused by October 30 will qualify for limited-time benefits," Mila said. Amazon is reportedly offering four key benefits:

If you get your products into the warehouse and upload images by October 30, you'll get a 50% discount on shipping fees for three months after the Low-Price Store opens, with rates as low as $0.25 per item. The more you list, the more you save.

No storage fees for stocked items until the end of 2024.

Sellers who complete listings and image uploads by October 30 will get access to ad benefits, including ad credits and ad creation services.

Low-Price Store sellers get special customer support, offering step-by-step help with the listing process.

How Temu Responds?

Amazon started off selling books, and after bringing in Chinese sellers through its third-party platform, tons of unbranded items has been sold there. Against this background, most shoppers on Amazon don't care about brands—they choose based on reviews.

For over a decade, Amazon has been ramping up its efforts for their deliveries in the U.S., with some items even arriving within hours. But the rise of Temu has shifted the game, showing that some consumers would rather wait for cheaper items than pay extra for fast delivery.

Marketplace Pulse points out that before Amazon, companies built brands to win consumer loyalty. But Amazon changed the game by directing people to look for cheaper alternatives beyond brand names, which made Temu's rise possible.

Now, Temu competes with Amazon by selling the same kinds of products at even lower prices. With its new Low-Cost Stores, Amazon is kind of going back to what it used to do — selling affordable, unbranded items, but at prices low enough to challenge Temu.

"American consumers are willing to wait for bargains when it comes to small fashion, home, and lifestyle products," an industry expert told Brands Factory. "That's why Amazon chose these categories for its initial trial run of the Low-Price Store." The expert also noted that there's no connection between Amazon's main site and the Low-Price Store, easing some sellers' concerns about possible impacts on their main brand sales.

Locked in a new round of price wars, Amazon, like Temu, is vying for Chinese sellers. However, the difference lies in their approach—Amazon is carving out a new territory for unbranded products, while Temu is shifting its focus toward semi-managed partnerships with branded sellers.

Lately, Temu rolled out a fixed-fee sales option for U.S. sellers, and if they manage their own shipping, there are no extra charges for ads or logistics. This move is seen as a direct response to Amazon's rising service fees, which have been piling up, including new fulfillment and Prime discount fees added earlier this year.

Brands Factory noted that top Amazon sellers like Anker and Costway have already started selling on Temu as well, and well-known brands like Midea, Xiaomi, Liby, and Vinda have also teamed up with Temu.

"Temu demands that products be priced at least 15% to 35% lower than on Amazon," a seller explained. Sellers can afford to set lower prices because Temu's fees are much less. In comparison, Amazon reportedly earned around $140 billion in 2023 from services like logistics, account management, and other seller support.

Fight Beyond the U.S.

While Amazon's Low-Price Store made its debut on the U.S. site, the rivalry between Amazon and Temu has far expanded beyond the U.S. market.

Temu's global growth has the data to back it up. According to Stocklytics, by the end of August, Temu's app had been downloaded over 735 million times. In August alone, the app saw nearly 55 million downloads worldwide, a 42% year-over-year increase.

In the UK, the gap in monthly active users between Temu and Amazon is narrowing, with Amazon reaching 15.8 million users in August and Temu at 13.1 million. In Germany, despite its late launch in April 2023, Temu's order volume had climbed to fourth place by the second quarter of 2024, following Amazon, eBay, and Otto. The German Retail Association (HDE) reports that Temu and Shein send about 400,000 packages to Germany daily.

A new survey from the Danish Industry Confederation indicates that in Denmark, Temu's popularity and recognition have quickly surpassed those of Amazon and eBay. Jacob Kjeldsen, director of the DI Retail Division, stated that Temu is now the third most recognized online marketplace in Denmark, following Zalando from Germany and Boozt from Sweden. About 22% of Danes surveyed shopped on Temu last year.

In South Africa, a local consumer ordered a phone case from both Amazon and Temu, only to discover that not only was Temu's phone case cheaper, but it also arrived faster—within just five business days. However, there were some shortcomings with Temu; the consumer noted that the package didn't show any updates during transit, and it only indicated it had reached the airport several days after the order was placed.

In contrast, Amazon's tracking system was more frequently updated, and their packaging was more secure. This highlights Amazon's strong control over its logistics supply chain.

On September 18, Amazon announced the launch of a new end-to-end supply chain service designed to assist sellers with efficient shipment of products from manufacturers to customers. This service will be available to all U.S. sellers in October, with plans for a global rollout by the end of the year.

With this new service, sellers simply need to enter product details and pickup locations, while Amazon will handle everything else — like carrier pickups, inventory, restocking, and placing products in distribution centers nearest to customers. "This service can speed up delivery times and potentially save both time and costs."

Whether it's the Low-Price Store or this new supply chain solution, it's clear that Amazon is trying hard to keep up with the competition.