Inside Sunvalley: How It Trained China's Top Amazon Sellers

From Amazon Top Seller to Entrepreneurial Springboard

Yang Meng, co-founder of Anker Innovations, is one of the most prominent figures in China’s cross-border e-commerce industry. But before he built Anker into a global brand, it was Sun Caijin, a senior from his alma mater, who introduced him to the business.

Often called the godfather of China’s cross-border e-commerce, Sun has kept a low profile despite his outsized influence. Today, he runs Typhur Technology, a high-end kitchen appliance brand, but his legacy is tied to Sunvalley Group (also known as Zebao), the company he founded in 2007.

Sunvalley was an early success story in China’s Amazon-driven e-commerce boom. Within three years, it surpassed ¥100 million ($13.64 million) in sales, and by 2020, revenue had soared to ¥5 billion ($682.01 million). In 2018, SACA Precision acquired Sunvalley for ¥1.53 billion ($208.69 million), taking it public through a reverse merger.

But rapid growth came at a cost. A power struggle led to Sun’s departure in 2020, and just a year later, Amazon suspended 330 of Sunvalley’s accounts, wiping out 70% of its stores and triggering a sharp revenue decline.

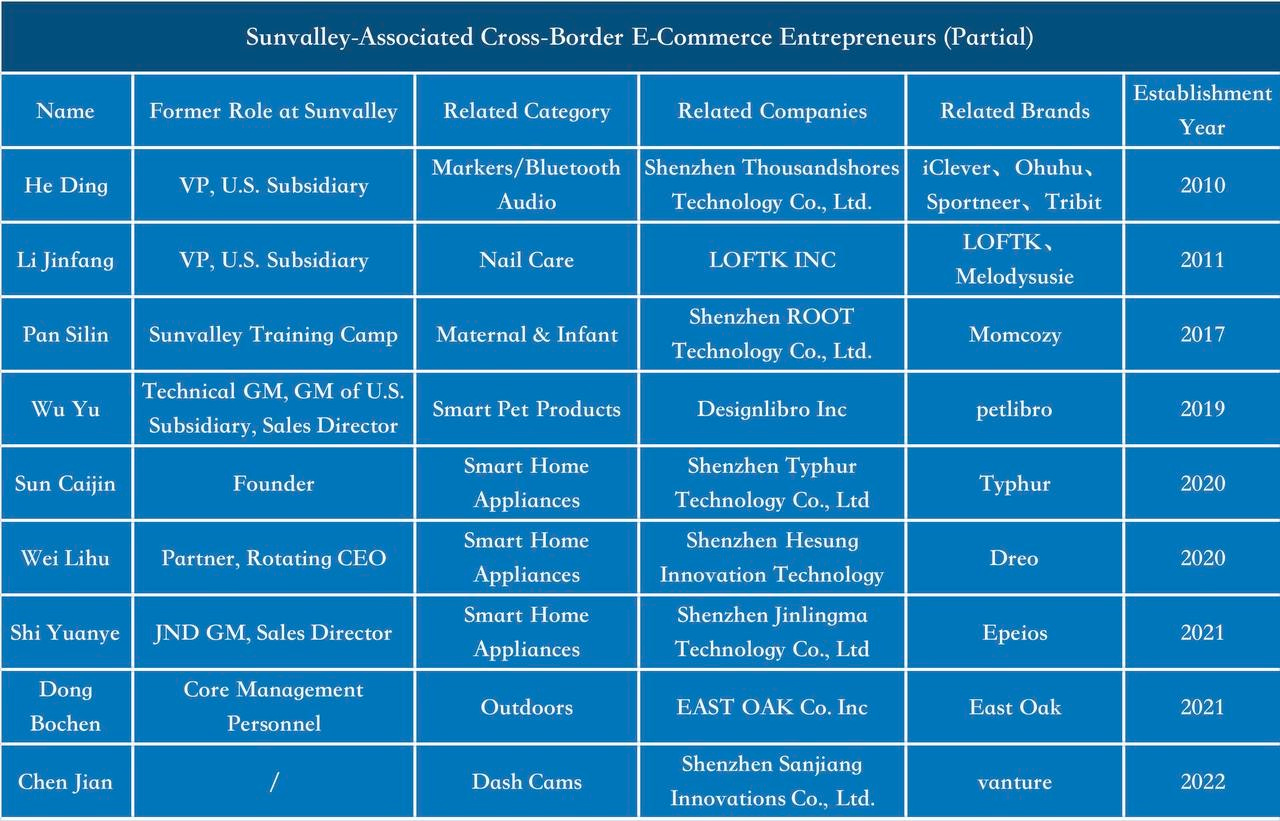

Despite its challenges, Sunvalley shaped China’s cross-border e-commerce ecosystem, alongside Anker Innovations and Patozon. Many of its former employees have gone on to launch their own successful brands.

One standout is Momcozy, a maternity and baby care brand founded in 2017 by Pan Silin, an alumnus of Sunvalley’s training program. By August 2024, the brand had sold 5.21 million units on Amazon North America, generating $230 million in revenue, according to SellerSprite.

Other brands with roots in Sunvalley include Melodysusie, Petlibro, Dreo, Epeios, and Vanture, all of which have secured significant market share in their respective categories.

Sunvalley’s Meteoric Rise—and Fall

In 2007, Sun Caijin founded Sunvalley in Shenzhen, setting the stage for one of China’s biggest cross-border e-commerce success stories. Initially selling on eBay, the company quickly pivoted to Amazon, where it became a dominant force in consumer electronics. Alongside Anker Innovations and Patozon, Sunvalley was part of the "Amazon Trios", a group that helped define China’s Amazon-native brand ecosystem.

From 2010 to 2020, Sunvalley’s sales surged 50-fold, climbing from ¥100 million ($13.64 million) to ¥5 billion ($682.01 million). Sun’s strategy was clear: aggressive category expansion, supply chain optimization, and a focus on high-quality, affordable products—particularly in 3C electronics and power banks.

But rapid growth came with challenges. In 2015, a supply chain inefficiency caused a major inventory crisis, forcing Sunvalley to bring in Japanese investors and new management to restructure operations. By 2016, the company had recovered, doubling down on R&D investments—spending up to ¥80 million ($10.91 million) annually—and expanding into offline retail markets, particularly in the Middle East, where top employees earned year-end bonuses of ¥1 million ($136,401).

In 2018, Sunvalley hired an Apple brand executive to revamp its marketing and brand strategy, shifting away from an Amazon-first model. That same year, it was acquired by SACA Precision for ¥1.53 billion ($208.69 million), a deal that sent SACA’s stock soaring for three consecutive days.

By 2020, Sunvalley was generating ¥5 billion ($682.01 million) in revenue, contributing 85% of SACA's total sales. The company explored an IPO and a reverse merger, but internal power struggles erupted. By September 2020, Sun Caijin left, followed by most of the original management team.

The aftermath was brutal. By 2021, Sunvalley’s workforce had shrunk from 958 to 757, with an estimated 90% turnover among senior staff.

The Product King of China’s Amazon Boom

During his tenure at Sunvalley, Sun Caijin focused on product innovation over daily operations, frequently traveling to the United States to study middle-class consumer trends. His approach was simple: anticipate demand, then build best-in-class products to meet it.

One of his most notable successes was the VAVA laser projector. Sun assembled an R&D team from Changhong and Xiaomi, investing ¥200 million ($27.28 million) in development. In 2019, VAVA’s 4K Ultra Projector, priced at $2,600, raised $2.15 million via crowdfunding, cementing the brand’s position in the North American projector market.

Sun’s philosophy of building ahead of demand influenced many entrepreneurs from Sunvalley’s ecosystem. In 2017, the company launched a $199 dashcam, which failed commercially. But former Sunvalley employee Chen Jian took these lessons and created Vanture, a brand that now dominates the North American and European dashcam markets.

Similarly, Melodysusie, a nail care brand founded by former employee Li Jinfang, turned Sunvalley’s 2013 $20.99 nail lamp success into a multi-billion-dollar business.

Now, Sun applies the same product-first approach at Typhur Technology, a high-end kitchen appliance company. With over 100 employees, nearly 60% in R&D, and talent from DJI and Dyson, Typhur is betting big on the future of home cooking innovation.

From Sunvalley to Startups

By 2020, as Sunvalley faced internal turmoil and China’s cross-border e-commerce sector continued its rapid ascent, many of the company’s top executives departed—only to launch their own ventures.

Among them was Wu Yu, former GM of Sunvalley’s U.S. subsidiary, who in 2019 founded DesignLibro in Shenzhen and launched Petlibro, a smart pet brand. Specializing in automatic feeders, water dispensers, and related accessories, Petlibro quickly secured millions in funding from Sequoia Capital and, by 2023, became the top seller in its category on Amazon U.S.

A year later, executive departures peaked. Wei Lihu, Sunvalley’s former rotating CEO, founded Hesung Innovation and launched Dreo, a home appliance brand focused on kitchen and small appliances. Within its first year, Dreo surpassed ¥300 million ($40.92 million) in sales and, by 2023, dominated U.S. Amazon sales in the tower fan and heater categories (Stackline data).

Hesung’s momentum caught investor attention—securing Series A funding within a year and completing five rounds of financing. Another former Sunvalley executive and rotating CEO, Huang Haoqin, is now a Hesung shareholder.

Sunvalley’s influence runs deep. Its management framework shaped the strategies of many of its former executives, who have applied its rapid-scaling model to their own businesses.

By the end of 2020, most of Sunvalley’s top executives had left, including four former VPs and the directors of R&D and branding. Among them, Shi Yuanye launched Epeios in 2021, mirroring Dreo’s approach but with a broader product range, including electric toothbrushes, kettles, air fryers, and even bath salts. Unlike Dreo, which targets the U.S. market, Epeios focuses on Japan.

While their product strategies vary, these new ventures share a common foundation: a focus on home appliances for middle-class consumers, a vision pioneered by Sunvalley and its founder, Sun Caijin.

Now, as the industry evolves, all eyes are on Sun Caijin’s current move.