SHEIN's New Roadmap

The $100B Fast-Fashion Giant SHEIN is Trying to Take on Amazon Through its Integrated Marketplace

SHEIN remained in relative obscurity in the Western markets before 2021. Things changed dramatically, particularly after Not Boring published Shein: The TikTok of Ecommerce, which significantly increased the brand's visibility among the West. Over the past two years, SHEIN has been featured frequently in mainstream medias like WSJ and Bloomberg, emerging as a rival to traditional fast-fashion powerhouses like Zara.

SHEIN's success is built on its flexible supply chain and savvy social media strategies. Over the past three years, the company has undergone substantial development. Let’s take a quick look at the progress SHEIN has made during this period.

SHEIN beats Amazon as the most installed e-commerce app in the US

In 2022, SHEIN surpassed Amazon for the first time ever as the most downloaded shopping app in the U.S. In the same year, SHEIN saw remarkable growth with an annual GMV of $29B USD, marking a 45% increase from the previous year and exceeding ZARA's annual sales for the first time.

SHEIN more than doubled profits to $2B in 2023

SHEIN's profit in 2023 surged by 55% to reach over $2B USD, with a total GMV of roughly $45B USD, surpassing the entire sales of its rival Inditex, Zara's owner, for the first time. In comparison, Inditex sales in 2023 grew 10.4% to reach 35.9B euros ($38.12B USD).

SHEIN was once valued at $100B, more than the combined valuations of H&M and Zara

Global investors pumped SHEIN's valuation up to $100 billion USD in April 2022, making it the world's third most valuable startup behind ByteDance, the Chinese parent of TikTok, and Elon Musk's SpaceX.

SHEIN's been on fire lately over the past three years, expanding rapidly on a global scale while adeptly catering to local preferences, akin to the success of TikTok. However, it is important to note that e-commerce presents a distinct set of challenges that are far more complex than those faced by social media platforms. This article will explore how SHEIN is reinventing itself in this intricate landscape.

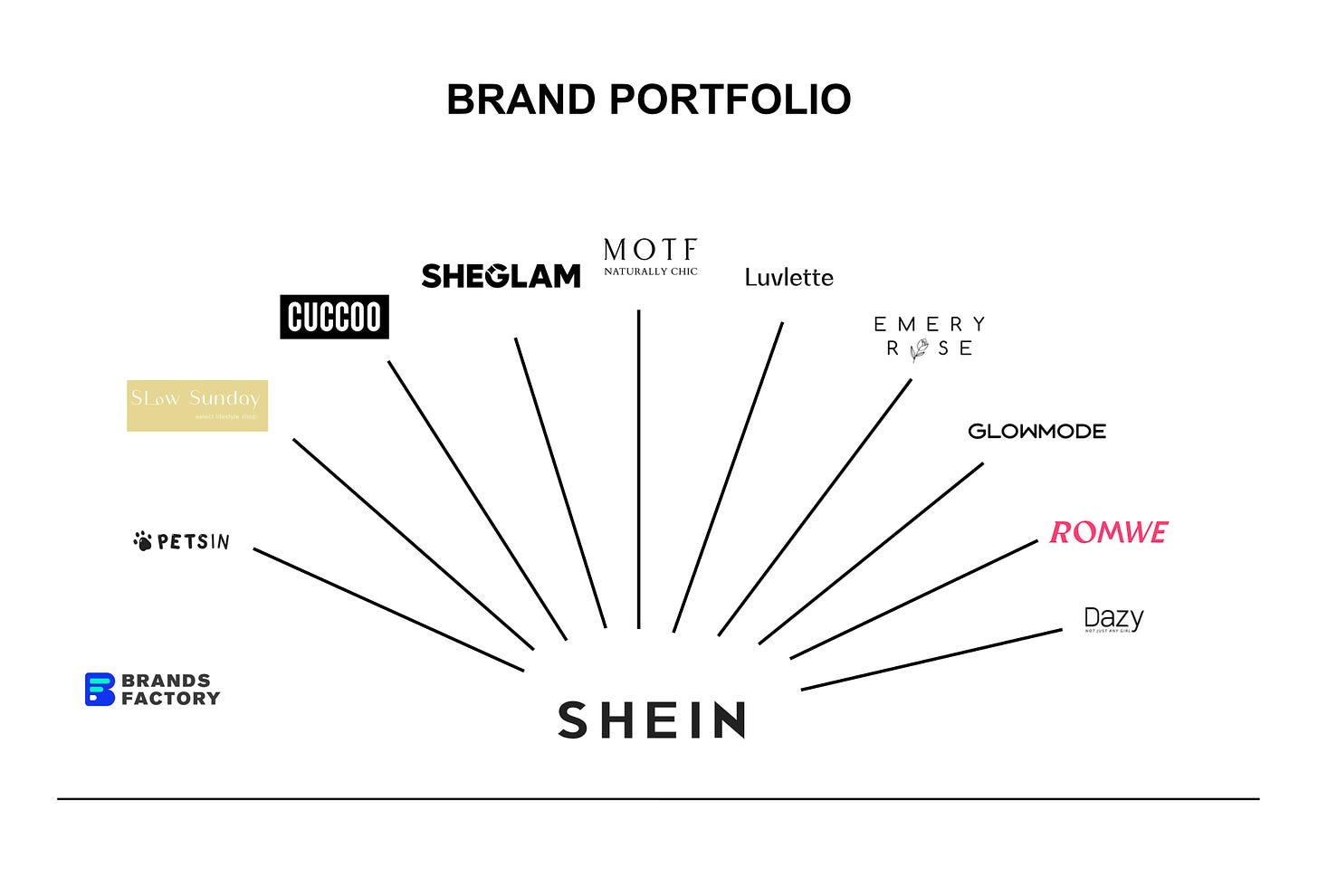

Brand Portfolio

There are two major strategies behind SHEIN's rapid growth: developing an Amazon-like marketplace and launching more sub-brands to create another SHEIN, which help shield SHEIN from geopolitical risks as well.

On May 4, 2023, SHEIN announced the launch of its global integrated marketplace. SHEIN Marketplace, initially introduced in Brazil, now is available in Mexico and US. The platform encompasses local and international third-party sellers on the SHEIN site alongside SHEIN-branded apparel products, as the company expands to meet increasing demands for product variety.

SHEIN Marketplace allow sellers to access SHEIN's real-time insights and learn from the company's on-demand production and demand measurement capabilities. "SHEIN is committed to delivering the best shopping experience for customers and empowering the communities where we operate while doing so," said Sky Xu, Chief Executive Officer of SHEIN.

Besides the marketplace, SHEIN has a more discreet strategy in play: replicating its success to launch more DTC brands.

Industry insiders attribute SHEIN's thrive in European and American markets not only to its supply chain prowess but also to its far-sighted marketing, exactly riding the waves of social media's booming. Up to now, SHEIN's main official account has gained over 30M followers on Instagram. Through partnerships with countless micro-celebrities and fashion bloggers, SHEIN now boasts the largest follower base on social media among fast-fashion industry.

Leveraging its robust supply chain in womenswear, SHEIN seeks to maintain the competitive pricing and quality of its sub-brands while replicating its proven marketing strategies.

Initially, SHEIN introduces new product lines on its main site for trial sales and testing, while also providing trust endorsements for sub-brands. After building trust and gather feedback from users, SHEIN would launch independent sites for these brands to precisely target new consumers.

Meanwhile, SHEIN facilitates the growth of its sub-brands on social media by leveraging a prominent main account to amplify the reach of smaller sub-accounts, thereby accelerating their development. This strategic deployment on social platforms ensures that they effectively engage with their target audience from the outset.

Through a series of innovative initiatives and expansion strategies, SHEIN has expanded its portfolio to over ten brands, each targeting specific market segments to cater to diverse consumer needs and preferences. This array includes:

ROMWE: Focus on youthful fast fashion, appealing to trend-conscious young adults.

EMERY ROSE: Offers sophisticated fashion for mature women, combining elegance with contemporary styling.

MOTF: Positions itself in the high-end apparel sector, providing premium quality at competitive prices.

DAZY: Specializes in Korean-style fashion, known for its chic and minimalist designs.

Glowmode: A sportswear brand that blends functionality with fashion, suitable for active lifestyles.

Luvlette: An intimate apparel brand that focuses on comfort, style, and inclusivity.

SHEGLAM: SHEIN's cosmetics line, offering a wide range of affordable beauty products.

Cuccoo: A footwear brand that provides stylish options ranging from casual to formal.

PETSIN: A pet brand catering to the needs of pets and pet owners, with a focus on quality and style.

Slow Sunday: A lifestyle concept shop featuring homeware and other daily goods crafted by creative souls from around the globe.

ROMWE and MOTF are SHEIN's experiments in different directions. ROMWE operates like another SHEIN with its own main site, app, and third-party seller integration. Meanwhile, MOTF keeps prices reasonable but pushes the upper price limit, marking SHEIN's entry into the higher-end market.

Growth via Acquisitions

SHEIN's acquisitions of its rivals come at a time when the company is looking to further expand its global influence.

Early in 2014, SHEIN formally acquired its Chinese rival ROMWE to expand new product categories. One year after that, the company announced its acquisition of US-based Make Me Chic, alongside its decision to establish a customer service center in the United States, which significantly increased the market share of North America. Concurrently, SHEIN also integrated the entire founding team of ZZKKO, the original name before it became the trendsetter we know today, into its operations during the same year to improve the mobile shopping user experience.

In 2022, SHEIN made a significant £300M ($322.94M USD) bid to acquire the UK's largest privately owned fashion retailer Arcadia, home to renowned brands like Topshop, Topman, and Miss Selfridge. Despite the unsuccessful bid, SHEIN remains committed to its trajectory of mergers and acquisitions.

SHEIN x Forever 21

In August of last year, SHEIN acquired approximately one-third shares of the joint venture company SPARC Group, marking the first time SHEIN has invested in an established brand. SPARC Group operates several clothing brands, including but not limited to the fast fashion brand Forever 21, outdoor brand Nautica, and mid-range men's clothing brand Brook Brothers.

Following the acquisition agreement, SHEIN planned to feature Forever 21's products on its website and mobile app with extra substantial online traffic. While Forever 21 boasts numerous physical stores and its own digital sites, this deal allowed the brand to tap into SHEIN's vast online user base of up to 154 million users.

SHEIN x Missguided

Subsequently, in October 2023, SHEIN has bought the Missguided brand from Frasers Group, marking the e-commerce giant's first purchase of a British brand. Founded in 2009, Missguided was one of the largest online fashion retailers in the UK. However, the pandemic and rising costs due to inflation led the brand to file for bankruptcy in May of last year. Frasers Group subsequently acquired it for £20M ($21.52 USD) in June. It's worth noting that SHEIN was one of the bidders for Missguided at that time.

Going Offline

Apart from building a strong technology-driven marketplace, SHEIN is also putting effort into offline retail. As consumer preferences shift, the company is experimenting with pop-up stores in various global locations, starting from London, New York, and Dubai.

SHEIN Pop-up Stores

Unlike traditional brick-and-mortar stores, SHEIN's pop-up stores primarily offer try-on and viewing services, enabling customers to make online purchases via QR codes after experiencing the products. Besides, the wide range of product offerings continues to attract consumers to queue up for the in-store experience.

In November 2022, SHEIN opened its first ever permanent physical store in Tokyo as the online retailer takes the next step after multiple pop-ups. The space may also be modified to host fashion shows and designer events as needed, the spokesperson said.

Recognizing the growing importance of in-person experiences, SHEIN will keep going offline with a plan to open approximately 30 pop-up stores in major cities across EMEA (Europe, Middle East, Africa) region, the North America, and Asia this year.

SHEIN's acquisition of Forever 21 is also inseparable from its parent company SPARC Group's offline store network. SHEIN opened a pop-up store within a Forever 21 store located in Ontario, Canada, covering 20% of the store's total area. During a four-day promotional period, it attracted over 7,000 visitors, resulting in a 62% increase in comparable sales compared to the same period the previous year.

Supply Chain Diversification

In response to increasing geopolitical tensions and market pressures, including criticism and regulatory scrutiny in various countries, SHEIN is actively seeking to expand part of its production beyond China, diversifying its supply chain.

In January 2024, Peter Pernot-Day, SHEIN's Head of Strategic and Corporate Affairs for North America and Europe, emphasized SHEIN's continuous efforts of localization in new markets, with a special focus on the United States, the European Union, and Brazil for the year 2024. Pernot-Day expressed particular enthusiasm for the brand's growth in Brazil, revealing SHEIN's substantial investment of over $50 to $100M USD in the country's garment manufacturing industry. Once operational, this investment aims to serve both Brazil and the broader Latin American market.

Reuters reported that SHEIN will complete the localization of its supply chain in Latin America by 2026.

Brazil

In July 2023, SHEIN signed an agreement with Coteminas to invest approximately $150M USD in Brazil for 2,000 of the textile company's apparel manufacturers to become SHEIN's suppliers to serve the Brazilian and Latin American markets. To date 336 partnerships have been signed, of which 213 are producing clothes across 12 Brazilian states, according to the company. In this way, SHEIN aims to ship 85% of its products made in Brazil around Latin America by 2026, said Fabiana Magalhaes, Director of Local Production at SHEIN Brazil. Currently, 70% of SHEIN's products sold in Brazil come from China.

In early 2023, SHEIN made a strategic move by appointing Marcelo Claure, former CEO & COO of SoftBank Group International, as the Chairman of SHEIN's Latin American. Insiders revealed that part of Marcelo's job is to extend local supply chains in Brazil and other regions through cooperation with local companies and manufacturers. Later in August 2023, Marcelo Claure was named as Group Vice Chairman of SHEIN.

"Marcelo's leadership and relationships have been instrumental in strengthening SHEIN's business development and strategy in key markets. We are fortunate to have Marcelo's unparalleled expertise at scaling global companies as we further expand SHEIN's marketplace model, localization strategy and other key initiatives to further meet the needs of our customers in over 150 markets." said Donald Tang, Executive Chairman of SHEIN.

Mexico

In a bid to optimize delivery efficiency, SHEIN is also doubling down on its investment in Mexico. In October 2023, Mauricio Vila, the Governor of Yucatán, announced SHEIN's plan to set up its production and distribution center in Yucatán, backed by a substantial $100M USD investment. The new factories in Mexico promises to significantly shorten delivery times and lower distribution costs across Latin America, marking a significant move for SHEIN to expand into the Latin American market.

Yucatán was chosen primarily for its advantages in nearshoring and high-quality textile. Emulating successful models from Brazil and other regions, the forthcoming factory will collaborate closely with local garment and goods manufacturers. And SHEIN is gearing up to forge strategic partnerships with local manufacturers, aiming to facilitate small businesses in promoting their products on the platform while offering them trainings to navigate the evolving e-commerce dynamics.

"SHEIN's localization strategy allows us to shorten delivery times to customers while expanding product variety and supporting local economies," said Marcelo Claure. SHEIN is "continuing to explore nearshoring options," he added, referring to manufacturing closer to the point of sale. Through this move, SHEIN is also looking at making Mexico a production hub for other countries, including potentially the United States.

Turkey & India & Other Countries

Meanwhile, SHEIN has been accelerating its manufacturing activities in Turkey, one of the world's largest cotton producers, where it tries to recreate its "small order and quick response" business model. By the end of 2023, 20% of SHEIN's sales in Europe originated from Turkey. Local production is also being considered in India under a partnership in May 2023 with Mukesh Ambani's Reliance Industries Ltd, India's largest multinational conglomerate headquartered in Mumbai.

Furthermore, SHEIN launched three distribution centers in Poland, Italy, and the United Arab Emirates, shortening delivery times in the serviced areas from 2 weeks to 3-4 days. After Whitestown, Indiana, SHEIN also plans to build two more warehouses in the US that should bring delivery times down from 1-2 weeks to 3-4 days. This will be highly necessary for its marketplace since Amazon offers same-day and next-day delivery to 72% of US customers.

Review

SHEIN has emerged as one of China's most successful global ventures, following in the footsteps of TikTok, despite its cautious approach to overtly aligning with a Chinese identity. Its success illustrates the powerful combination of social media dynamics and a flexible apparel supply chain. Shein's growth trajectory depends not only on its internal strategies but also on its ability to navigate global geopolitics and expand its international presence.