TikTok Marketplace Monitor|February, 2025

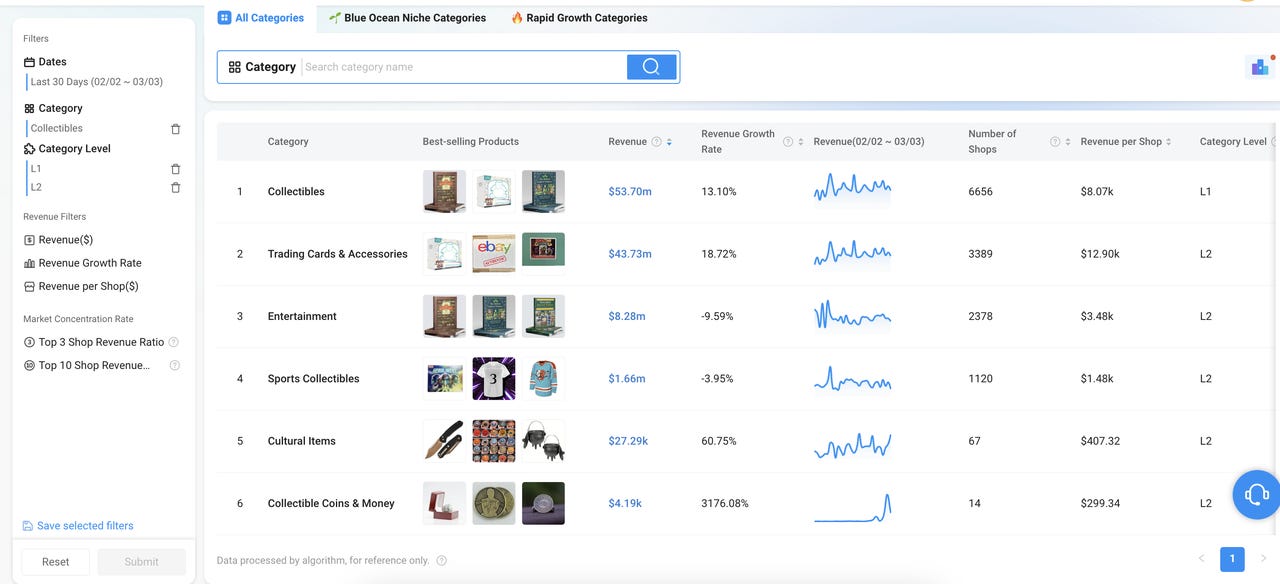

Trading Cards & Accessories accounted for 81.43% of the Collectibles sales.

OVERVIEW

TikTok Shop USA's gross merchandise value (GMV) fell 10.38% in February to $710.21 million, with daily sales averaging $25.36 million. The decline follows the post-Chinese New Year slowdown and continued store closures since January.

Since January, TikTok Shop USA has intensified its crackdown on noncompliant stores, targeting inconsistencies in registration, fraudulent information, and multi-IP associations. New stores and multi-account sellers have been hit hardest.

Data from Kalodata revealed that the top 10 categories generated $507.47 million in GMV, down 8.3% from January. Beauty & Personal Care (17.68%), Womenswear & Underwear (11.83%), and Health (7.68%) accounted for 37.19% of total GMV, slipping 1.84% month-over-month.

Category Analysis

In February, TikTok Shop's top 10 categories remained largely stable, with Collectibles as the only new entrant. The market slowdown, which began in December 2024, deepened in January as all categories saw declines. While the downward trend continued into February, the losses were less severe than in the previous month.

In January, Phones & Electronics and Home Supplies saw the steepest drops, falling 46.97% and 35.52%, respectively. Fashion Accessories and Menswear & Underwear also posted sharp declines of 33.04% and 32.33%.

By February, the hardest-hit categories shifted, with Sports & Outdoor and Phones & Electronics leading losses at 22.72% and 20.08%. Meanwhile, Household Appliances recorded the smallest decline at just 1.07%. Health performed relatively well, slipping 4.8% but climbing from 4th to 3rd place.

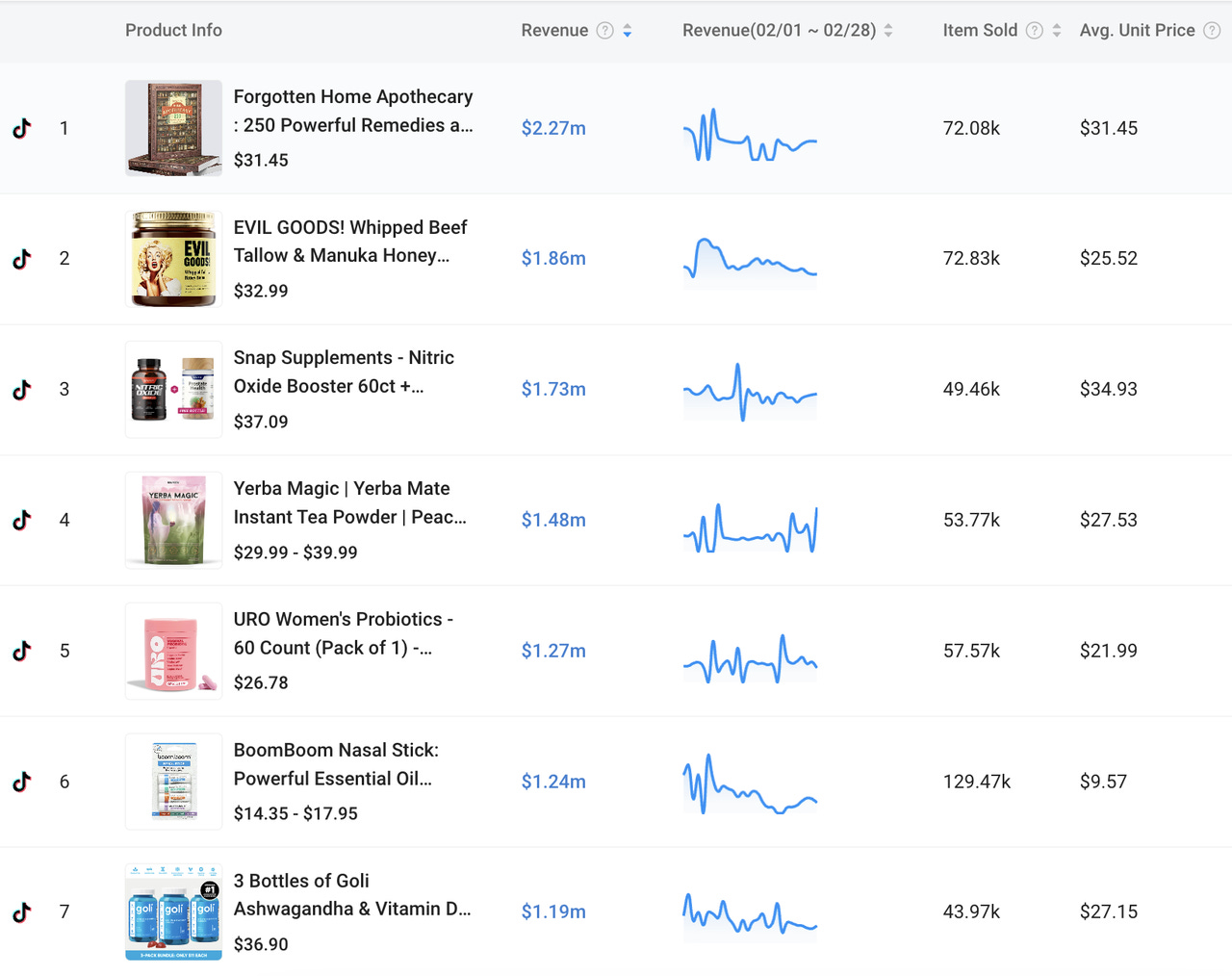

February saw notable shake-ups in best-selling products. Wavytalk's Hair Brush (Beauty & Personal Care) and Zoyava's Soothe & Smooth Bundle (Health), both on the list for at least two consecutive months, dropped off the rankings.

Meanwhile, The Lost Skills' Herbal Remedies (Collectibles) held the top spot despite a revenue drop to $2.27 million from $3.35 million in January. EVIL GOODS' Honey Balm (Beauty & Personal Care) climbed to second place, even as sales dipped from $1.96 million in January to $1.86 million.

Vendors Spotlight

February saw intensified competition among TikTok Shop USA's top sellers, with five new entrants from five different categories shaking up the rankings. Notably, Halara US, which had held the top spot for 12 consecutive months, dropped off the list entirely.

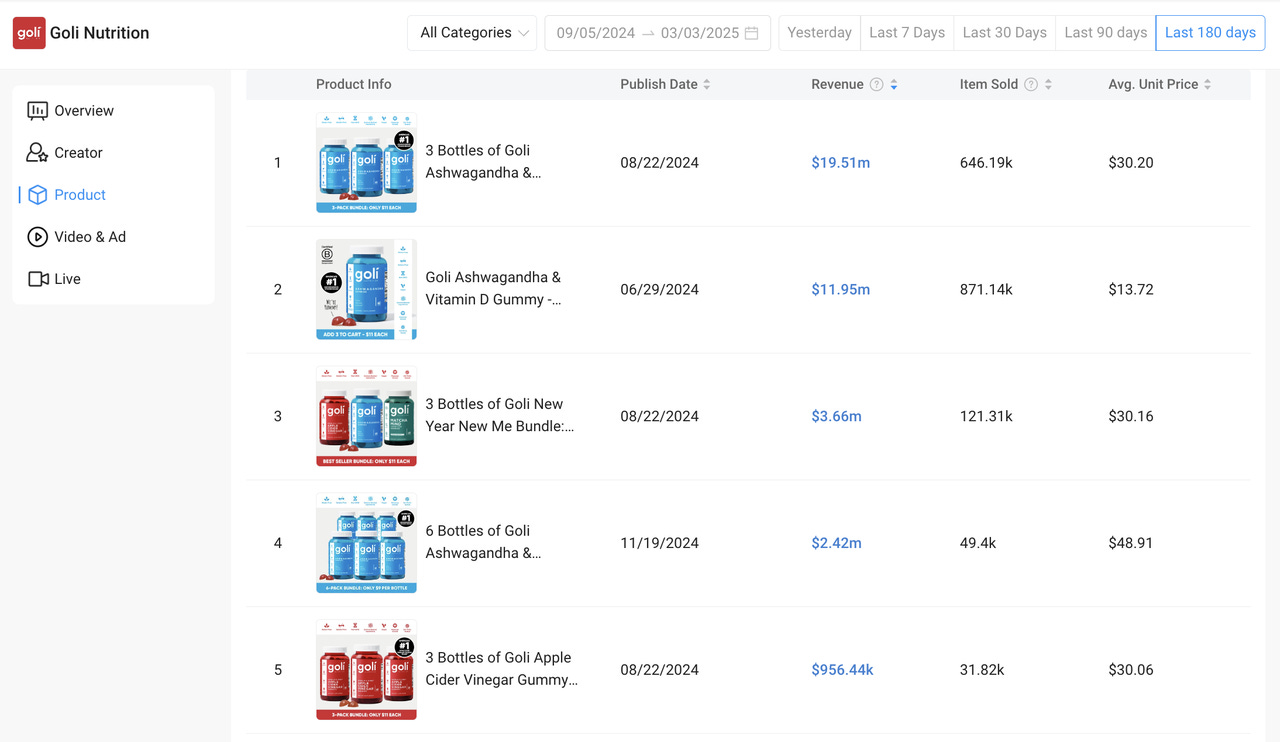

Goli Nutrition (Health) claimed the No. 1 position with $5.22 million in monthly sales. As a consistent top performer, the brand has occupied its space in the rankings for seven straight months since August, fueled by its Ashwagandha & Vitamin D Gummies.

To maximize sales, Goli Nutrition strategically listed the product under three different links: a single bottle at an average price of $13.72, a three-pack at $30.20, and a six-pack at $48.91—bringing in a total of $33.88 million over the past 180 days.

In 2024, the global gardening equipment market size was estimated at $96.86 billion, with North America leading at 35.3%. March to May marks peak gardening season in the region, driving demand for tools, seeds, and fertilizers. Historically, U.S. horticultural sales rise from February, peak in May and June, and remain strong through Q3.

With North America's peak gardening season approaching, horticultural sales are climbing. VEVOR, a Chinese MRO tools brand, reenter the top seller rankings at No. 6 with $3.3 million in sales after a two-month absence. In the Garden Supplies subcategory, VEVOR claimed two of the top five bestsellers, with notably high average unit prices.

Another key development is the entry of meccaofsc (Collectibles) into the top 10 sellers with $3.13 million in sales. The sports card market has been gaining traction on TikTok Shop, driven by nostalgia and collectible trends. Over the past 30 days (Feb 2–Mar 3), the Collectibles category generated $53.7 million in sales, with its sub-category Trading Cards & Accessories dominating at $43.73 million—81.43% of the total—growing 18.72% month-over-month.

Another newcomer, Bella All Natural (Food & Beverages), debuted with $2.68 million in sales. Mirroring Goli Nutrition's strategy, one of its best-sellings Probiotics Iced Coffee leveraged tiered pricing across single, two-pack, and three-pack listings.

DATA SOURCE FROM KALODATA