TikTok Shop Falls Short in the U.S.

From GMV Below Targets to Live Stream Issues and Political Risk

On Monday, September 16th, the U.S. government and TikTok went head-to-head in federal court as oral arguments began in a critical legal battle over the platform's future in the country, where nearly half the population uses it.

TikTok and its parent company, ByteDance, based in China, are challenging a U.S. law requiring them to either sell off their U.S. operations or face a potential ban by mid-January. President Biden signed the legislation into law in April, teeing up a countdown for TikTok's sale. The case is likely to proceed to the U.S. Supreme Court.

While TikTok navigates significant uncertainty in the U.S., its TikTok Shop has not met expectations this year.

GMV Below Expectations

Since its trial launch in May 2023 and official debut in August, TikTok's e-commerce (TikTok Shop) in the U.S. have fallen short of expectations.

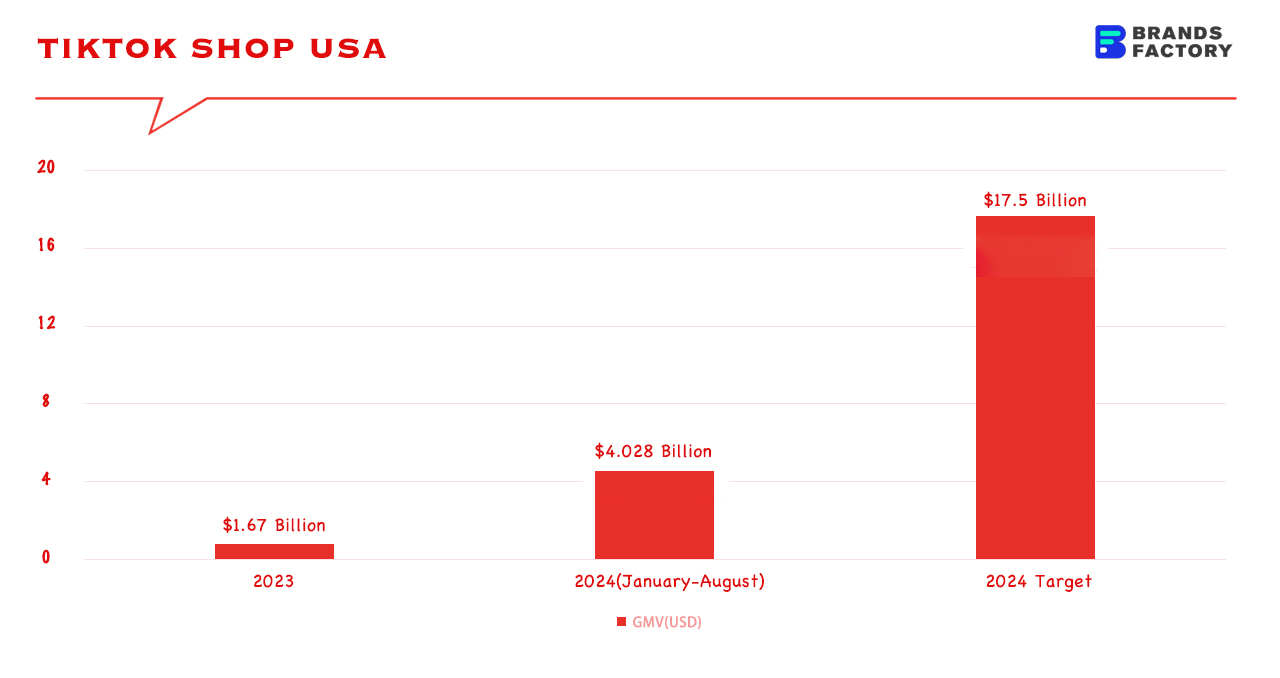

At the start of 2024, TikTok set an ambitious goal for TikTok Shop to reach $50 billion in GMV, a 150% increase. The U.S. market alone must contribute at least $17.5 billion, which is even ten times more than last year's GMV. However, by the end of 2023, the platform was generating just $14 million per day in the U.S. To meet the $17.5 billion goal, the daily GMV would need to exceed $45 million throughout the year.

In the first half of this year, TikTok Shop's average daily sales in the U.S. exceeded $20 million, doubling from the end of last year. However, it's still quite a bit short of the $45 million daily target. In contrast, as of May, Temu's global daily sales hovered around $90 million, with over 35% coming from the U.S. market—though Pinduoduo denies this.

TikTok Shop has also set a daily peak goal for the second half of the year, aiming for $75 million in U.S. daily GMV, but it still has a long way to go. Last year, this figure hit around $16 million, although big events like Black Friday have pushed daily sales beyond $30 million.

Given TikTok's past performance and the controversies it faced in the U.S. earlier this year, the targets for the second half seem incredibly ambitious. As of September, TikTok Shop's U.S. performance is looking bleak.

Data from Tabcut shows that from January to August 2024, TikTok Shop's U.S. GMV only reached $4.028 billion. If Bloomberg's earlier report of a $17.5 billion target for the year is accurate, they've only achieved 23% of that goal in eight months. Tabcut also revealed that TikTok Shop hit its highest monthly GMV of the year in July, reaching $68.7 million, but this dropped to $65.7 million in August, marking the second month-on-month decline this year, the first being in February.

The notion of "poor platform performance" is widely circulated among ByteDance and merchants. Sources close to TikTok suggest that adjusting the targets is not off the table.

In response to the growing pressure, TikTok has been making some changes, with many feeling that the platform is taking a more aggressive approach.

Over the past six months, the entry requirements for TikTok's U.S. marketplace have fluctuated. For instance, when recruiting Amazon partner stores, TikTok initially required $2 million in annual sales and at least one product ranked within the top 100,000 on Amazon.

After the possible ban issues, this was relaxed to $2 million in total sales across platforms, leading to an overwhelming number of merchants and ads. The threshold was later raised again to $2 million on Amazon alone, though it remains more lenient than last year. The minimum follower count for U.S. creators to promote products was also reduced from 5,000 to 1,000. As of May 15, creators in the U.K. can sell U.S. products through their storefronts as well.

In addition, TikTok Shop in the U.S. used to only accept sellers who could ship their goods locally. But with competition from Temu and Shein, TikTok Shop followed suit and launched a full-managed option in August 2023, allowing products to ship directly from China to U.S. customers. It's said that the team's priority has shifted from increasing GMV to securing profits.

To solidify its presence in the U.S., TikTok has also slowed down its global expansion. In 2023, TikTok Shop delayed its entry into Brazil, Ireland, and Spain to focus on its U.S. launch in the second half of the year. In 2024, with Biden's "sell or ban" legislation against TikTok, the company has again shelved its plans to enter eight more countries, including Japan and Germany.

The reason is simple—TikTok wants to focus its resources on stabilizing the U.S. market. A TikTok insider said that if the U.S. merchants don't see consistent investment from the company, they might panic and leave.

Live Stream Dilemma

TikTok Shop made its debut in the U.K. in 2021. The main reason for starting in the U.K. was that its consumer behavior and purchasing power closely resemble those in the U.S., making it an ideal testing ground for a future U.S. launch.

However, despite the initial hopes of replicating the success of Douyin's e-commerce model, it soon became clear that this wouldn't be as easy. Livestream shopping, which thrives in China, hasn't taken off overseas, and people weren't used to buying through livestreams.

Two years later, when TikTok Shop launched in the U.S., the same problems popped up. Data shows that 80% of TikTok's U.S. sales come from short videos made by creators, while live shopping only brought in less than $500 million last year, making up no more than 20% of the total.

Just like in Europe, U.S. users don't shop through livestreams, and the shortage of hosts adds to this challenge. Plus, the offline retail market is thriving, and the competition is much tougher than in Europe or Southeast Asia.

Besides giants like Amazon, Temu has expanded into 48 countries with low-priced goods. In just over a year, Temu has become the second most popular shopping app in the U.S., with around 15% of Americans making purchases.

The first major challenge is the lack of content. Much like its early days in the U.K., most of TikTok Shop's initial hosts in the U.S. were Chinese sellers. However, with their limited English, they couldn't deliver content that resonated with local audiences, which ended up hurting TikTok's overall user experience.

Since 2024, more U.S. sellers have been joining TikTok, and local influencers are starting to replace the original hosts. But new issues have surfaced—U.S. hosts are far fewer and less engaged compared to other regions.

For instance, while e-commerce hosts in Southeast Asia average about 2.5 hours of livestreaming daily, in the U.K. and U.S., it's only around 20 minutes. This short streaming time usually only allows a host to cover 2-3 products, leading to unstable viewer engagement and poor conversion rates, which hampers the development of a dynamic live shopping scene.

A service provider for TikTok Shop expressed frustration with local hosts' lack of dedication, stating, "Real results require streaming at least 6 to 8 hours a day." Unfortunately, there are no U.S. success stories like Li Jiaqi, so influencers lack the incentive to commit to the demanding live shopping format. Unlike in China, influencers abroad can earn more easily through ads on YouTube and Instagram.

A TikTok Shop source shared that there are two main ways to tackle these issues. One is to highlight successful examples and train European and American hosts in China. The other is to help Chinese MCN agencies expand internationally. To encourage this, TikTok is offering up to 70% subsidies for live-stream sales events in the U.S., meaning that for every $100 in sales, TikTok refunds $70.

Moreover, Americans aren't into live shopping and rarely make impulse purchases. Facebook and Instagram both tried live shopping but eventually shut it down. U.S. users typically add items to their carts during livestreams and then check other sites for better prices before buying. If TikTok's prices aren't noticeably better, it may merely serve as a promotion for other e-commerce sites.

Promotional tricks that work in China, like offering "$20 off on orders over $100," have also proven ineffective in the U.S. A TikTok Shop insider noted that American users prefer straightforward discounts rather than dealing with a series of complicated tasks to earn a coupon with restrictions.

Another major issue is the inaccuracy of algorithms. TikTok once adopted a closed loop e-commerce system where users buy and sell products directly within the app, without being redirected to external websites or apps. Thus, there is not enough data about shopping behaviors of American TikTok users, leading to rough and vague user profiles with just their country and age range.

For live streams, figuring out what makes a live successful or how to get more traffic is still a mystery, according to an MCN agency insider. The algorithms need more time to improve.

When TikTok can't compete on price or product variety, it's focusing on building its live streaming ecosystem and boosting content conversion. One key tactic is to develop a few standout success stories. Since this summer's major sales events, TikTok's live e-commerce in the U.S. has seen a lot of positive results.

According to the FastMoss 2024 TikTok Ecosystem Development Report, live commerce on TikTok has been growing strongly in the first half of 2024. From January to June, there were 140 live streams in the U.S. where a single stream's GMV topped $100,000. Jeffree Star, SimplyMandys, and Stormi Steele have frequently broken GMV records. In June, Stormi Steele achieved a "million-dollar live stream" and even got a TV interview. A month later, Mandys Pena broke this record, with a single U.S. live stream hitting $1.21 million.

Despite a few influencers proving that live commerce can work, the market's scale effect has not yet materialized. Furthermore, the long-term view of the U.S. live commerce ecosystem is not yet mature. The million-dollar live streams mentioned earlier were all managed by MCN agencies from China.

Live commerce has already proven its potential and market space in China. Given enough time and patience, TikTok might also cultivate these consumer habits in Europe and America, much like Amazon or Shein took over a decade to establish their supply chains. "This will definitely happen; it's just a question of whether it happens in a year or five," said a TikTok e-commerce employee. However, time is currently TikTok's most luxurious resource.

More Uncertainties than Temu & Shein

In the U.S., Temu has always been TikTok's main rival.

In 2021, TikTok started semi-closed-loop e-commerce, letting users shop on other platforms through external links. Two years later, TikTok internally figured their daily average GMV in the U.S. was about $6-7 million. But within just one year of entering the U.S., Temu's GMV was already ten times more than TikTok's. Shortly after, TikTok's e-commerce followed Temu's lead by launching fully-managed services.

The so-called fully managed service means that cross-border merchants only need to list their products, while the platform takes care of product selection, pricing, warehousing, logistics, and after-sales. This approach can secure extremely low product prices, minimizing the barriers to selling internationally and drawing in many merchants to compete fiercely.

However, a year later, TikTok's managed services have made limited progress, currently accounting for only 1/5 of TikTok's e-commerce scale and relying heavily on high subsidies to retain users. A TikTok e-commerce insider said that to compete with Temu and Shein, TikTok's cross-border product subsidies once reached as high as 40%, but user retention dropped rapidly once the subsidies ended.

A Temu source mentioned that TikTok e-commerce doesn't have the edge in terms of pricing or product variety, so it can only rely on content for limited conversions. Until TikTok e-commerce can effectively build its product display model, replicating Temu's success will be challenging.

Unlike Temu and Shein, which are more like trading platforms, TikTok e-commerce is based on a social media platform. The scale of these platforms is also very different: Temu started from scratch, Shein's user base is predominantly female, while TikTok has over 180 million users in the U.S. This means TikTok is likely to face more regulatory challenges.

For instance, TikTok Shop has only expanded to nine countries in three years—six in Southeast Asia, the U.S., the U.K., and Saudi Arabia—whereas Temu achieved coverage in 56 countries in just a year and a half.

According to a TikTok insider, Temu's fast global expansion last year was due to their approach of "getting started before handling the details"—securing logistics and payment partners before resolving compliance issues.

TikTok, on the other hand, has to be extra careful given the unexpected bans in Indonesia and ongoing legal issues in North America. TikTok only dedicates around 2% of its content to e-commerce compared to 10% in Southeast Asia. Additionally, the requirements for U.S. TikTok Shop stores are still high; businesses need a U.S. Social Security number or to have over $2 million in annual sales on Amazon. Even though this requirement was lifted in July, it remains much tougher than Temu's.

When TikTok Shop launched in the U.S., it imposed strict requirements on merchants from the start. In May 2023, TikTok Shop began testing in the U.S., initially requiring shops to have a U.S. business license, a U.S. legal entity (with Chinese shareholders not exceeding 25%), and the ability to ship locally from U.S. warehouses.

Two months later, TikTok Shop allowed Chinese-owned American businesses to open cross-border stores, but still required a U.S. business license and local warehousing and shipping. It wasn't until the end of the year that TikTok Shop fully opened up cross-border store entry in the U.S.

Additionally, TikTok Shop has consciously minimized content related to China in its live streams.

A TikTok insider shared that TikTok e-commerce rates live streams by quality levels. Lower-quality streams often have issues like poor native English experience, hosts with weak English skills or mixing Chinese and English, too many Chinese cultural elements, or content that doesn't match local cultural norms. To create a more localized experience and better serve American users, TikTok has limited the traffic for some cross-border live streams in the U.S.

TikTok employees also face difficulties in accessing detailed data, like American user IDs, which would help them understand purchasing behaviors, social connections, and preferences on the platform.

To tackle the surge in Chinese cross-border e-commerce small packages, many European and American countries are either preparing to or have already raised tariffs on these packages. Previously, packages under $800 entering the U.S. were duty-free, and the EU had a €150 tax-free limit. Starting in April, the U.S. Department of Homeland Security announced it would increase scrutiny of low-value packages sent directly to the U.S., while Europe is moving forward with plans to tax cheap goods.

This means that if the tax breaks for cross-border direct mail packages are removed, the price advantage of fully managed products will be reduced. However, in a semi-managed model, where merchants handle customs themselves, this won't affect them.

Even though Chinese e-commerce platforms are now using a semi-managed model, they're competing with about 400,000 Amazon China sellers and DTC sites, making it a fierce battle. For TikTok Shop, still exploring the U.S. market, this is a significant challenge. Currently, Temu and Shein together hold just 2% of the U.S. e-commerce market, while Amazon controls 36%. Additionally, nearly 60% of Amazon Prime orders in Q1 this year were delivered the same day or next day, thanks to Amazon's $100 billion investment over 18 years and its 185 distribution centers around the world.

The UK used to be TikTok's entry point for e-commerce in Europe and America. However, today, the market growth has slowed significantly, with the scale even smaller than countries like Thailand, Vietnam, and Malaysia in Asia. The conflicts and challenges TikTok e-commerce faced in the UK have clearly shown whether it can succeed in this tough business.

Success hinges on how much TikTok can transition from a global corporation to a more "Chinese-style" company—embracing aggressive expansion, bold marketing strategies, and a heavier reliance on Chinese infrastructure (anchors, MCN agencies, goods, and logistics). Yet, in today's US market and amid a complex geopolitical landscape, achieving such a transition seems increasingly challenging.