VEVOR: Mastering Cross-Border E-Commerce in MRO Tools

VEVOR's Rise From 600mn to 8bn in 5 Years

A recent study from GRAND VIEW RESEARCH revealed that the North America's MRO (Maintenance, Repair, and Operations) market, valued at $157.80 billion in 2023, is expected to grow by an average of 2.6% per year from 2024 through 2030. Yet even Grainger, the leading brand, captures only 7% of the U.S. market, signaling vast growth potential.

In response, a new wave of Chinese cross-border e-commerce companies has risen, leveraging competitive pricing to challenge industry giants like Grainger. VEVOR is a standout in this field, having seen its revenue soar from just a few hundred million yuan to over 8 billion RMB ($1.13 billion) in just a few years. Its valuation has also surged from a few million yuan to over $1 billion, with revenue doubling nearly every year.

VEVOR specializes in MRO tools and equipment, selling worldwide on platforms like Amazon, eBay, and its own DTC site, and now serves over 10 million members. In 2020, VEVOR hit 3 billion RMB ($423.63 million) in revenue, making it China's top MRO tools retailer in cross-border business.

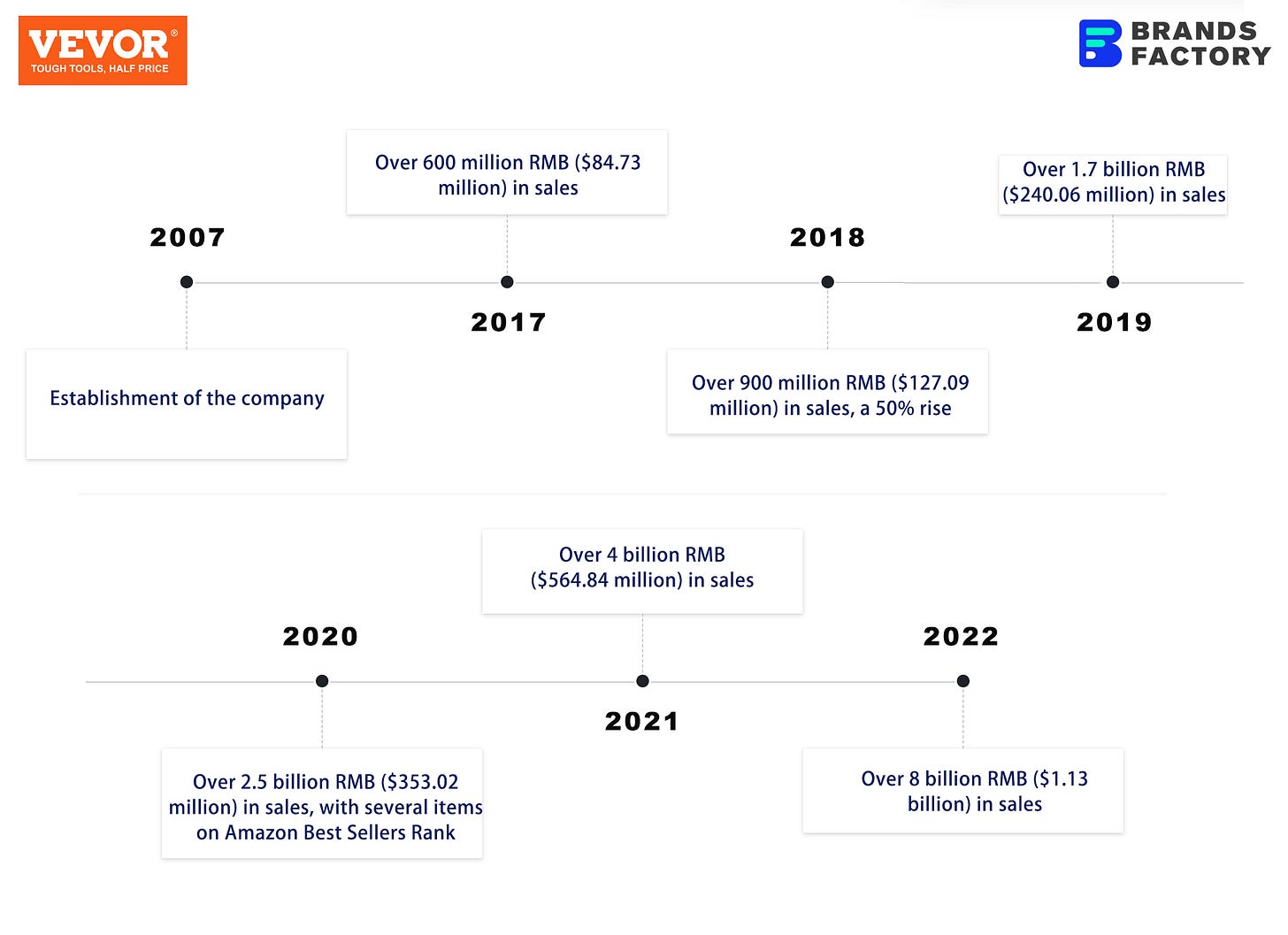

600mn to 8bn in 5 Years

Jiao Rubao, the founder of VEVOR, initially started his business journey not in MRO tools but in the apparel sector. Despite being well-known within Shanghai's cross-border e-commerce circles, the company only took off after moving into MRO tools.

In 2012, VEVOR began selling on eBay, and by 2015, sales hit 240 million RMB ($33.79 million). They soon moved to Amazon as well, and by 2017, they were growing fast — seeing over 50% revenue growth for several years straight.

In 2017, VEVOR diversified its product lines and refined its offerings, with global sales surpassing 600 million RMB ($84.73 million) for the first time.

In 2018, as the company continued to expand, VEVOR's monthly sales exceeded 70 million RMB, reaching 900 million RMB ($127.09 million) in global sales.

By 2019, VEVOR's sales worldwide jumped 88% year-on-year to 1.7 billion RMB ($240.06 million).

In 2020, VEVOR's sales skyrocketed to 2.5 billion RMB ($353.02 million), with several products topping the tool category, prompting the launch of its own DTC site.

In 2021, VEVOR broke the 4 billion RMB ($564.84 million) sales mark for the first time.

By 2022, VEVOR was projected to hit a record 8 billion RMB ($1.13 billion) in global sales.

Today, VEVOR stands as a leading MRO supplier integrating production and supply chain, with over 60 warehouses in major markets like Australia, Canada, Germany, the UK, and the U.S., reaching 200 countries and serving more than 10 million users globally.

Some Chinese investors Vevor's incredible growth boils down to two main factors.

The biggest one is simply the opportunity in the MRO market, which has long been strong in Europe and the U.S., led by well-known companies like Grainger, Fastenal, and Wurth. Grainger, for instance, a Fortune 500 name, made $13 billion in 2021. However, these companies still primarily relies on traditional, offline sales channels and focus heavily on conventional B2B sectors like manufacturing, transportation, and construction.

But the consumer market for home tools has always been huge, too. "In Europe and the U.S., B2C MRO makes up 40% of the whole market," says Li Tong, a senior investment manager at Foresight Capital, who knows this sector well.

Before, the B2C market mostly relied on offline channels, which couldn't grab market share quickly online. VEVOR has stepped in to fill that gap, focusing on online sales for regular consumers, boosting MRO e-commerce penetration, and seizing the market previously held by smaller offline businesses via cost-effective offerings.

"And as VEVOR has grown, it's definitely built a name for itself. The bigger the name, the more the revenue; and the more the revenue, the bigger the name—it's a win-win situation." It's fair to say that "VEVOR is the one that's really made the most of this industry boom."

VEVOR's rise is a lot like companies such as Anker in cross-border e-commerce, using online strategies to outpace the competition and snag market share through its cost advantages.

The second reason is the people behind VEVOR. Founder Jiao Rubao entered the MRO sector early on, bringing valuable experience from his previous work in a factory, which equipped him with insights into large-scale supply chain management.

VEVOR's team made their mark in this area by focusing on three essential aspects. First, managing a complex supply chain for bulkly items isn't easy, but they pulled it off. Second, they prioritized building their overseas warehouses to ensure smooth logistics and inventory management—another challenging task. Third, they have been meticulous in their online operations.

With advantages in supply chain efficiency and high operational effectiveness, VEVOR consistently ranks at the top across all its categories on Amazon, showcasing its impressive capabilities.

VEVOR on Social Media

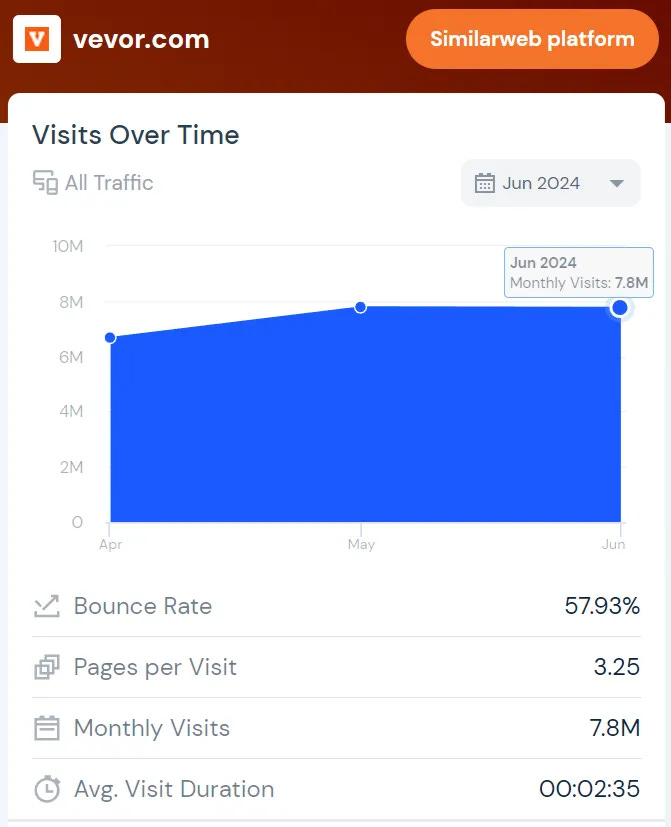

Today, vevor.com gets about 7 to 8 million visitors each month, with 69.1% of those from the U.S., making it the number one site in its category within the U.S.

The main traffic sources include direct access, paid search, organic search, and social media, making up 36.03%, 32.34%, 13.29%, and 12.57%, respectively.

For paid search, VEVOR spends about $200,000 a month, with peak costs hitting $530,000 in busy periods. Given the variety of VEVOR's offerings, the company targets about 1,500 keywords, focusing primarily on product names, broad categories, and brand names.

VEVOR's social media strategy is essential for connecting with users. By creating carefully planned content and encouraging strong user interaction, VEVOR has built a significant brand presence on social media. The company utilizes platforms like Facebook, YouTube, Instagram, and Pinterest to share the latest projects, helpful tips, product reviews, and a variety of DIY-related content, successfully engaging users with diverse interests.

Facebook accounts for a significant portion of VEVOR's social media traffic, with 150,000 followers and generating 59.82% of its traffic. VEVOR's Facebook page is more than just a space for product information; it's a lively community where users share their DIY creations and exchange tips and advice, creating a supportive and collaborative environment.

YouTube also plays a key role, contributing 34.21% of the traffic with its high-quality videos showcasing tool operations and DIY projects, which attract a dedicated audience.

On platforms like Instagram and Pinterest, VEVOR captivates users with stunning images and creative layouts that spark inspiration. With a bunch of well-crafted videos and illustrated tutorials, VEVOR shows off how easy its products are to use and the creative projects you can tackle, while also getting users to share their own creation processes and final results.

This approach not only boosts user retention but also allows potential customers to discover and trust VEVOR's products through user-generated content (UGC) on social media.

Despite TikTok's low traffic share, its creative content, featuring short videos that showcase product applications, DIY projects, and unique tool uses, has quickly caught the eye of tons of young users.

Last September, VEVOR launched its TikTok shop in the U.S., and in a year, VEVOR has achieved sales of $15.38 million with 248,080 units sold, ranking first among similar stores and marking a new growth avenue for VEVOR.

Looking at the data, a big chunk of VEVOR's sales comes from the promotional videos made with influencers on the platform. In the last month alone, VEVOR has been linked to 4,250 of these videos from 1,800 influencers, racking up an estimated $2.72 million in sales.

By working with various influential creators, VEVOR has successfully enhanced its brand presence while also driving direct sales conversions. This collaborative approach effectively pairs the popularity and trustworthiness of these creators with VEVOR's product quality and value, capturing the attention of many potential consumers.

VEVOR's thoughtful strategy on TikTok is evident in its follower count, which now stands at 68,000 dedicated fans. This figure highlights not just VEVOR's rising influence on social media, but also the impact of its continued investments and community-building efforts. This data showcases how VEVOR effectively utilizes TikTok to achieve both brand promotion and sales growth.

New MRO Players After VEVOR

"In 2019 and 2020, when VEVOR was doing well, a bunch of sellers formed teams to jump into this field. Some made it, some didn't, but hitting over 300 million RMB ($42.24 million) in sales isn't that tough. I know a few that hit 500 and 600 million RMB ($70.40~$84.49 million) , and one even reached 500 million RMB ($70.40 million) in just one year," shared an investor familiar with the MRO sector.

This company started in 2018 in Wenzhou and focuses on welding products, such as machines and helmets. Their brand has taken off, growing at a rate of 1.5 times or even more each year. An investor mentioned they made about 500 million RMB ($70.40 million) in revenue in 2022. Interestingly, this company doesn't want to raise money or go public.

From what's been reported, YesWelder has two founders: Zhu Chengfeng, who manages the brand and sales channels, and Zhang Zhouyou, who runs the e-commerce side. Zhu is around 40 and comes from a design background, so he really cares about the brand’s style. When you check out YesWelder's website, you'll see an awesome scene with sparks flying, featuring a model in a cool welding helmet doing some welding.

To achieve growth, YesWelder is working on expanding its offline presence after establishing its brand. "They mentioned plans to partner with Walmart and Home Depot in the future and are looking to develop offline distributors."

Aside from companies like VEVOR and YesWelder, many traditional brands are also thriving in Jiangsu and Zhejiang. Initially serving as OEM factories for big names like Bosch, these companies later launched their own brands and found success overseas. Relying on their supply chains and product quality, these traditional brands stand alongside rivals like VEVOR and YesWelder, while likely having stronger offline presence.

For instance, Chervon, an electric tool manufacturer that was founded in 1993, was a tool trader before moving into manufacturing, making products for well-known companies like Bosch and Flex. Later on, it launched its own brands, targeting the DIY home market in Europe and the U.S. with mid-to-high-end brands like SKIL, FLEX, EGO, and HAMMERHEAD, which are sold through major local home material stores.

In building brand recognition, Chervon understands that European and American consumers are highly loyal to tool brands they purchased before. Therefore, from the very beginning, Chervon opted to enter the European and American markets by acquiring mainstream tool brands. This strategy not only quickly elevated the awareness of its own brand but also expanded its product line.

The European tool brand FLEX, acquired by Chervon, has also successfully turned from loss to profit. Furthermore, the acquired American brand SKIL has impressively made it onto the "Top 100 Cross-Border E-Commerce Brand Influence List" in China.

Founded in 1994, Positec has achieved annual sales exceeding 3 billion RMB ($422.43 million). The company offers a diverse product line that includes power tools and garden tools, targeting both professional and DIY markets.

Its own brands feature WORX, which includes WORX Orange for DIY tools and WORX Green for professional tools, as well as acquired brands like ROCKWELL and KRESS. WORX Orange and ROCKWELL primarily serve major retailers in the U.S., Europe, and Australia, while WORX Green focuses on the domestic professional tools market.

Positec began as an OEM manufacturer, gradually establishing its own factories to produce for well-known international brands such as Bosch, Black & Decker, and Craftsman. The company has since grown significantly, with manufacturing bases located in Suzhou and Zhangjiagang.

Since its founding, Positec has gone through three major changes: moving from trade to manufacturing, then from manufacturing to OEM, and finally from OEM to establishing its own high-end brands. Each of these changes happened at a time when the company was gaining momentum, spurred by a sense of urgency. Founder Gao Zhendong noted in an interview that this feeling of crisis was a key factor.

"When we started trading in 1994, a small team of about twelve people managed to pull in $30 million in revenue in a year. If I recall correctly, the total export value of electric tools in China that year was $260 million. So, we made up over ten percent of that, which sounds quite impressive. But there's no such thing as a free ride. The reform and opening-up had only recently started; buyers didn't know where to find sellers, and sellers were equally lost. We were lucky to be in the middle. However, I knew that trade wouldn't generate real value—manufacturing is what creates genuine value. Once they started collaborating, I could lose my business, and that was a significant crisis."

In addition, several MRO brands are targeting emerging markets, such as Dongcheng and Boda. These companies have ventured abroad, establishing a strong presence in neighboring countries like Vietnam, Myanmar, Mongolia, and Russia. Currently, Boda is the leading power tool brand in Myanmar, while Dongcheng holds the top position in Vietnam.

In the near future, it is possible that VEVOR will face direct competition from them, signaling a new wave of rivalry among Chinese brands in the global market.