Week #7: Shein's Profits Doubled to $2 Billion in 2023 | The Neglect of User Experience Led to Alibaba's Lagging Behind

Latest news and analysis on China’s global e-sellers

Here’s our pick for last week’s news:

Shein's Profits Doubled to $2 Billion in 2023

Temu Expands to Central Asia with New Kazakhstan Site

Cleaning Robot Brand SMOROBOT Secured Series A Funding

Amazon Top Seller AUGROUP Applies for Listing in Hong Kong

TikTok Shop Raises the Referral Fee from 2% to 6%

Alibaba Chairman Joe Tsai: The Neglect of User Experience Led to Alibaba's Lagging Behind

Following AliExpress, Temu Sets up Seoul Office to Expand the Korean Market

Shein Embraces a Brand Portfolio with More Product Categories for Consumers

Shein's Profits Doubled to $2 Billion in 2023

Shein's profit in 2023 hit over USD 2 billion, with a total GMV of roughly USD 45 billion. This marks a 55% year-on-year growth in sales, surpassing the entire sales of its rival Inditex, Zara's owner, for the first time. In comparison, Inditex reported a net profit of USD 5.9 billion in its most recent fiscal year.

This dramatic improvement in profit is partly due to the reduction in logistics and production costs after pandemic, as well as Shein's strategic focus on protecting margins.

Despite Temu's formidable entry into the market in 2022, particularly in everyday essentials, it hasn't managed to undermine Shein's dominance in fast fashion. Shein's long-established supply chain network, directly linked to factory production and fabric sourcing, has been a key factor.

Now Shein has doubled down on its commitment to fast fashion, which can be seen through its recent acquisitions of brands like Forever 21 and Missguided. Besides, Shein is embarking on a "supply chain as a service" initiative to offer supply chain and technical support to outside brands and designers, marking a shift in its business strategy that will swerve it further away from the oncoming headlights of Temu.

Temu Expands to Central Asia with New Kazakhstan Site

Pinduoduo's global e-commerce platform Temu has made its official debut in Kazakhstan, marking its first step into Central Asia. Initially planning to establish a strong foothold in the US market before expanding globally by April 2023, Temu adjusted its strategy due to compliance concerns and now aims to optimize its global strategic layout in 2024.

The company plans to reduce its reliance on the US market by expanding its presence worldwide, with 55 countries already strategically established across Asia, Europe, North America, Latin America, Africa, and Oceania. The recent expansion into new markets indicates Temu's commitment to accelerating its global presence.

Cleaning Robot Brand SMOROBOT Secured Series A Funding

SMOROBOT has successfully secured a Series A funding round. Founded in 2021 , SMOROBOT specializes in pool cleaning robots.

In April, 2022, SMOROBOT TANK X robotic pool cleaner completed its first Kickstarter campaign, rasing USD 381,456 from 616 backers. This product's sales revenue hit nearly RMB 100 million(USD 13.8 million).

Primarily focused on the US and European markets, SMOROBOT mainly relies on retail channels for sales, alongside e-commerce platforms and its own DTC site.

Amazon top Seller AUGROUP Applies for Listing in Hong Kong

AUGROUP has filed an application for HK Main Board Listing. As per its prospectus, AUGROUP is dedicated to offering a range of sought-after furniture and home products under well-known brands like ALLEWIE, IRONCK, LIKIMIO, SHACERLIN, HOSTACK, and FOTOSOK.

AUGROUP is one of the most prominent cross-border e-commerce players based in Shenzhen. The company faced a significant challenge in April 2021 when Amazon shuttered the accounts of numerous Chinese sellers, including AUGROUP . Over the past three years, the firm has managed to recover from this setback, though its product focus has shifted from electronic accessories to home goods.

Relied mainly on Amazon in the US and Europe, AUGROUP reported that 11 of its brands exceeded a GMV of RMB 100 million (USD 13.83 million) individually in 2023. According to Frost & Sullivan, six products of the firm ranked first on Amazon US by sales revenue.

TikTok Shop Raises the Referral Fee from 2% to 6%

Starting April 1st, referral fees for products sold in the TikTok Shop was raised from 2% to 6%, before ultimately climbing to 8% on July 1st. There are a few exceptions: for products in electronics and collectibles categories, fees increased to and will stay at 6%, and fees for pre-owned items increased to and will stay at 5%.

TikTok Shop's decision will put pressure on smaller sellers on the platform. Even though TikTok Shop will still offer some product discounts and free shipping, mom-and-pop merchants who rely on low prices to draw customers may struggle. To help sellers adapt, TikTok Shop will gradually increase fees. Sellers will have to decide whether to raise their prices or try to maintain ultra-low pricing to stay competitive.

Alibaba Chairman Joe Tsai: The Neglect of User Experience Led to Alibaba's Lagging Behind

On April 3rd, the Norwegian Sovereign Wealth Fund released a video interview with Alibaba's co-founder and Chairman, Joe Tsai.

During the interview, Joe Tsai admitted that the key reason for Alibaba's lagging behind in the past few years was the neglect of user experience. "We forgot who our real customers were. Our customers are the people who shop using our app, and we were not providing them with the best experience."

Joe Tsai also pointed out the focus of the group's restructuring is to refocus on user experience. "So, to some extent, we shot ourselves in the foot by not truly focusing on creating value for users. As part of the restructuring, we brought in a new CEO Eddie Wu, who is 12 years younger than me. He is very customer-centric, focusing on products, interfaces, and user experience. This is what matters to us."

Following AliExpress, Temu Sets up Seoul Office to Expand the Korean Market

Pinduoduo, the owner of Temu, formally registered a corporation named "Whale Co., Korea Limited" on Feb. 23 to engage in e-commerce and related activities in the Korean market. Based in the U.S., WhaleCo Inc. operates as a subsidiary of Pinduoduo.

Temu's Korean corporation was registered with a total capital of 100 million won (USD 74,000), with the listed office in Jongno, Seoul. Temu entered South Korea last July. As of February, Temu boasted 5.81 million users, ranking fourth among e-commerce shopping apps in Korea, according to WiseApp.

On March 26, Temu and several other foreign e-commerce companies were notified by the Korean Fair Trade Commission to designate a domestic agent to directly address inquiries and resolve issues that arise with Korean consumers.

"With fierce competition between Coupang and AliExpress, Temu seems to enter the market in a more subtle approach," an insider official said. "This may explain why Temu's Korean corporation was disclosed after its registration for one month."

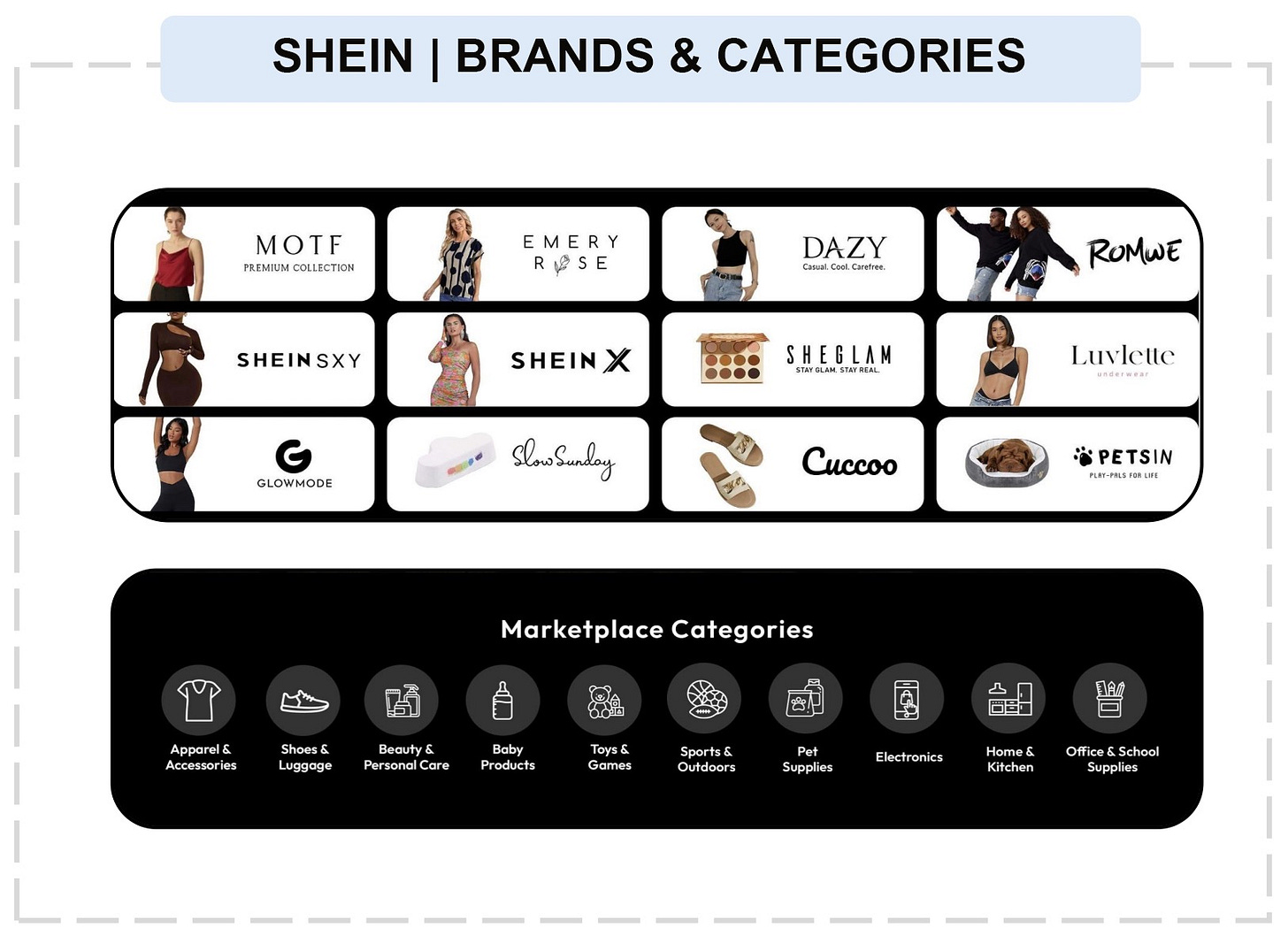

Shein Embraces a Brand Portfolio with More Product Categories for Consumers

Shein, a global integrated online marketplace of fashion, beauty, and lifestyle products, continues to expand its product categories through self-owned brands to fulfill customers' increasing demands for diversified products. Leveraging China's efficient and low-cost supply chain, Shein offers products in similar categories at prices that outmatch even those of Amazon, presenting consumers with more alternatives.

Through a series of innovative initiatives and expansion strategies, Shein has expanded its brand portfolio to over 10, including fast fashion brands like ROMWE, high-end clothing brand MOTF, European and American fast fashion brand EMERYROSE, activewear brand GLOWMODE, lingerie brand Luvlette, cosmetics brand SHEGLAM, footwear brand Cuccoo, and pet brand PETSIN, etc.