Will 'TikTok Refugees' Rescue Xiaohongshu's Global Push?

Xiaohongshu's Unexpected Rise Amid TikTok Ban

TikTok's potential removal from U.S. app stores by January 19, 2025 has triggered a wave of users searching for alternatives. Chinese lifestyle platform Xiaohongshu, also known as the Little Red Book, has emerged as a top choice, reaching the No. 1 spot on the U.S. iOS App Store's free charts by January 13.

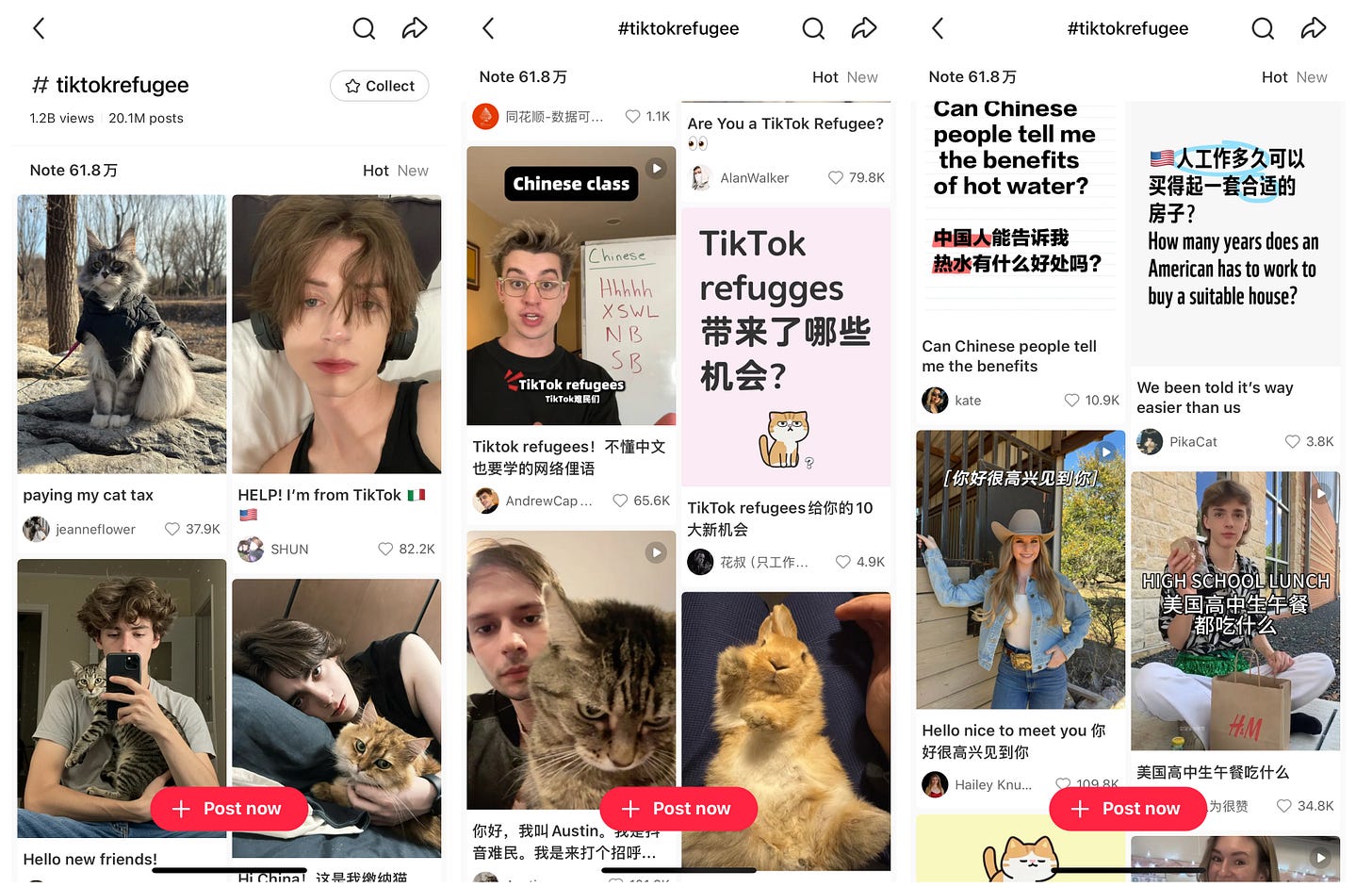

The surge, driven by "TikTok Refugees," generated over 1.2 billion views and 618,000 posts under the hashtag by January 17. While Xiaohongshu has long targeted international growth, its efforts to expand abroad via standalone apps have largely failed to match its domestic success.

This unexpected influx of U.S. users could signal a turning point, but whether Xiaohongshu can maintain momentum remains to be seen.

Xiaohongshu's Struggles with Global Expansion

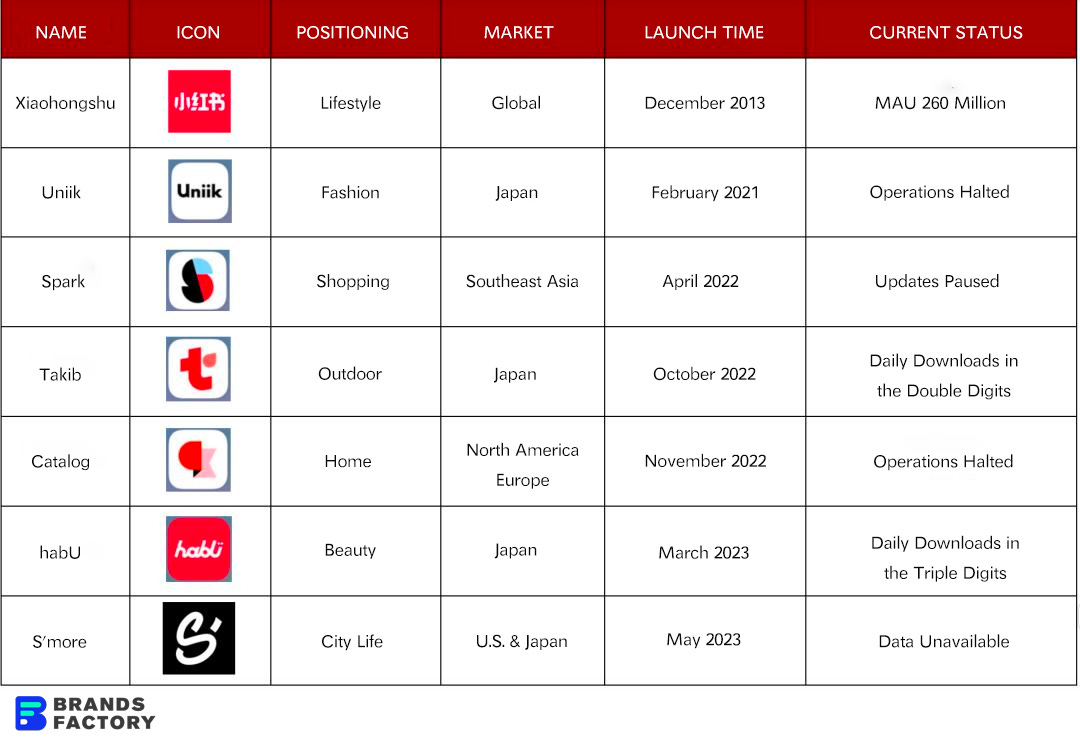

While Xiaohongshu continues to attract more overseas users, the company's other standalone global apps have fallen short.

Since 2021, the company has pursued international expansion.

Over the past three years, it has launched several independent apps targeting different regions:

Japan: the fashion community Uniik (Feb 2021), camping community Takib (Oct 2022), beauty community habU (Mar 2023), and city community S'more (Aug 2023, after a U.S. trial).

Southeast Asia: Spark (Apr 2022), mirroring the domestic Xiaohongshu.

Europe and U.S.: Catalog, a home-sharing community (Nov 2022), and S'more (May 2023).

Xiaohongshu has leaned on Japan as its primary international testing ground, given its cultural alignment with China. Yet, apps like Uniik and Catalog have failed to gain traction, forcing the company to discontinue both.

ByteDance's Lemon8, launched during the same period, has fared better by taking a bolder, more direct approach. For Xiaohongshu, the challenge is clear: can it replicate its domestic platform's success abroad, or should it focus on building niche communities tailored to specific regions?

While its global efforts have yet to produce a standout success, Xiaohongshu is now shifting gears, moving away from TikTok's approach and pursuing a more tailored path to international growth.

Xiaohongshu's Appeal Among Overseas Chinese

Xiaohongshu has struggled to expand internationally, but its appeal among overseas Chinese suggests a different path forward.

In Malaysia, where nearly a third of the population is ethnically Chinese, the app has gained significant traction. Entering the market in 2018, Xiaohongshu's popularity surged in 2021, fueled by the pandemic.

It now boasts 1.5 million users in Malaysia, with a global Monthly Active User base of 260 million. The platform's audience skews young—most are aged 20 to 35—and overwhelmingly female.

In Singapore, Xiaohongshu had 550,000 users in 2022, while in the U.S., influencers focus on career and lifestyle content.

To cater to this audience, the platform launched an international version, REDnote, in mid-2024. However, REDnote largely mirrors the domestic app and lacks features like translation, limiting its appeal beyond Chinese-speaking users.

Xiaohongshu has also targeted Chinese students and tourists abroad, running over 17,000 Traditional Chinese ads from 2021 to 2023 in markets such as Malaysia, Singapore, and the U.S. The app has become a trusted tool for travel, shopping, and lifestyle advice.

With competition from ByteDance's Lemon8, Xiaohongshu remains focused on overseas Chinese communities, forming a cross-border business team in 2024 to expand REDnote and drive its commercialization.

A Flood of Traffic, A Fortune in the Making

On January 13, 2025, a wave of U.S.-based users dubbed themselves "TikTok refugees" and flocked to Xiaohongshu. By 3 PM Beijing time on January 17, the hashtag had amassed 1.2 billion views, 20.1 million discussions, and 618,000 posts. The surge of "cyber refugees" even strained Xiaohongshu's servers, which were still not fully optimized for English-language users.

This sudden influx of traffic pushed Xiaohongshu to the top of the U.S. App Store's free chart on January 14.

Beyond the U.S., Xiaohongshu is also rocketing up the app download charts in Europe and Australia, where there is no imminent TikTok ban. Media reports indicate that Xiaohongshu ranks third in downloads in France and has topped the charts in Germany, Switzerland, Poland, Australia, Canada, Ireland, Iceland, Italy, and Sweden.

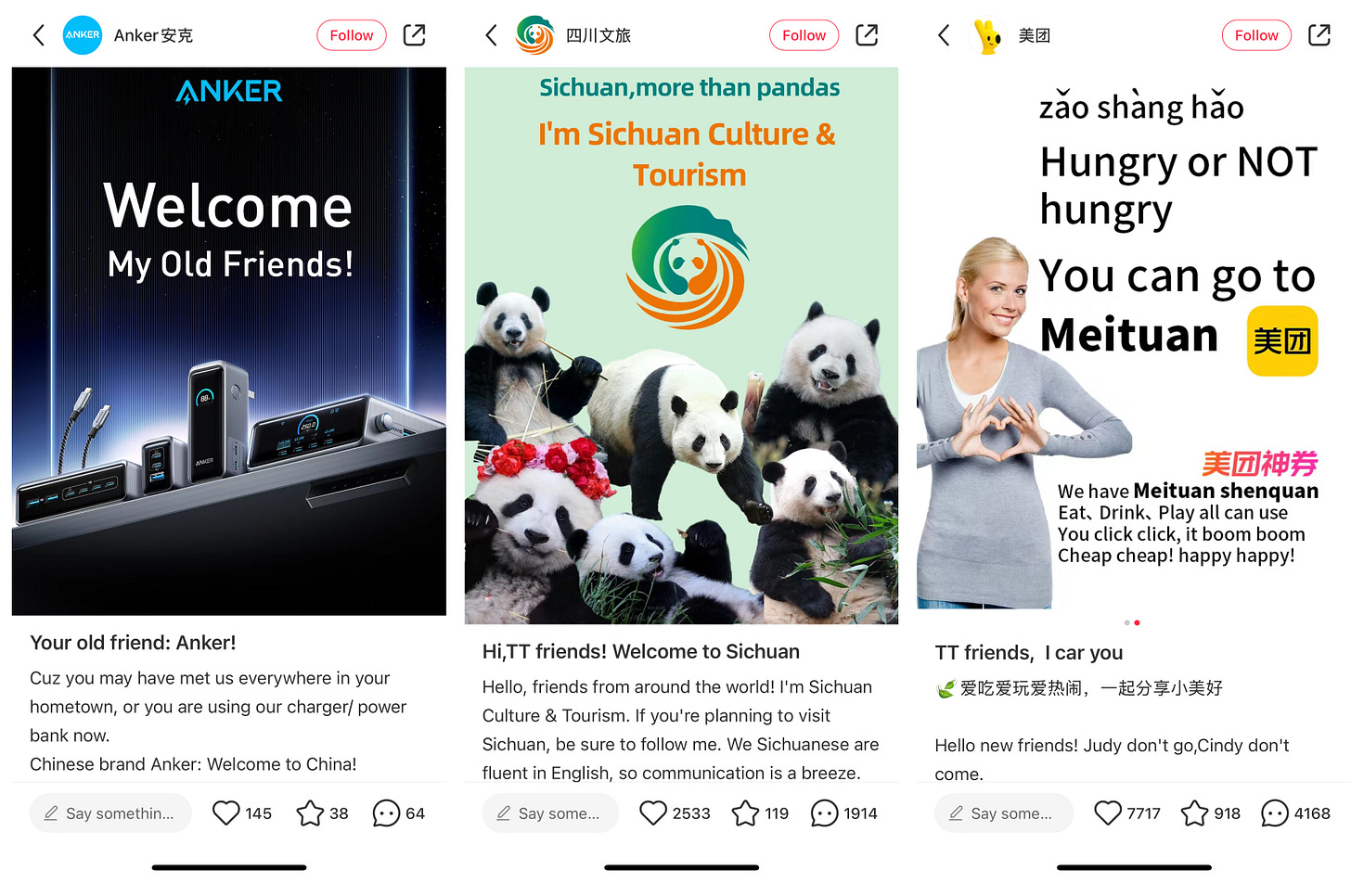

This growth is opening new opportunities for cross-border e-commerce sellers and domestic businesses. Major players in lifestyle sectors—food, fashion, and travel—as well as brands like Anker, Haidilao, Meituan, Ctrip, Luckin Coffee, Alibaba, Meitu, Tmall, and even Chinese cultural and tourism authorities, are increasingly turning to Xiaohongshu for marketing.

Many foreign trade folks have already started engaging clients by posting English-language videos and posts on Xiaohongshu. Some have even repurposed product videos and content originally shared on other platforms, re-uploading them on Xiaohongshu to attract international users.

The sudden surge in traffic has created immense opportunities for companies seeking to attract foreign users. However, no one believes this wave of traffic will last. Instead, the real question is whether Xiaohongshu will adjust its international strategy because of it. Will it continue focusing on Chinese-speaking users, or pivot—like Lemon8—to target users in other languages?

The TikTok Ban: A Psychological Power Play

Donald Trump’s handling of the TikTok ban is a textbook example of psychological manipulation targeting Gen Z. Here’s how the strategy worked:

1. Manufactured Crisis

By framing TikTok as a national security threat, Trump exploited the illusory truth effect—repeating a claim until it felt true. Targeting TikTok, a Gen Z cultural hub, triggered reactance psychology, where restrictions fuel rebellion, making his eventual reversal more impactful.

2. Perception of Power

Trump’s decision to lift the ban created the illusion he was more powerful than Congress. This leveraged the halo effect, positioning him as an independent disruptor, resonating with Gen Z’s distrust of traditional institutions.

3. Oversimplified Narratives

The ban boiled down to “Trump vs. Congress,” exploiting Gen Z’s reliance on quick, surface-level content. This relied on heuristics—mental shortcuts that simplified the issue, obscuring the deeper manipulation at play.

Takeaway for Gen Z

Trump’s TikTok manoeuvre reveals how easily emotional triggers and oversimplified narratives can be used to manipulate even the most skeptical generation. The solution? Stay critical, dig deeper, and question who benefits from the spectacle.

GQ