Y2 Model: Temu's Newest Answer to Rising Tariffs

Temu's Strategic Pivot: Direct Shipping from China

Facing Trump's hefty 145% tariffs on Chinese imports, Temu significantly raised prices last Friday. But price hikes alone aren't enough—Temu is shifting gears operationally.

On April 27, Brands Factory received notice from Temu's seller acqusition team about the launch of a new supply chain model, dubbed "Y2," tailored specifically for its US market.

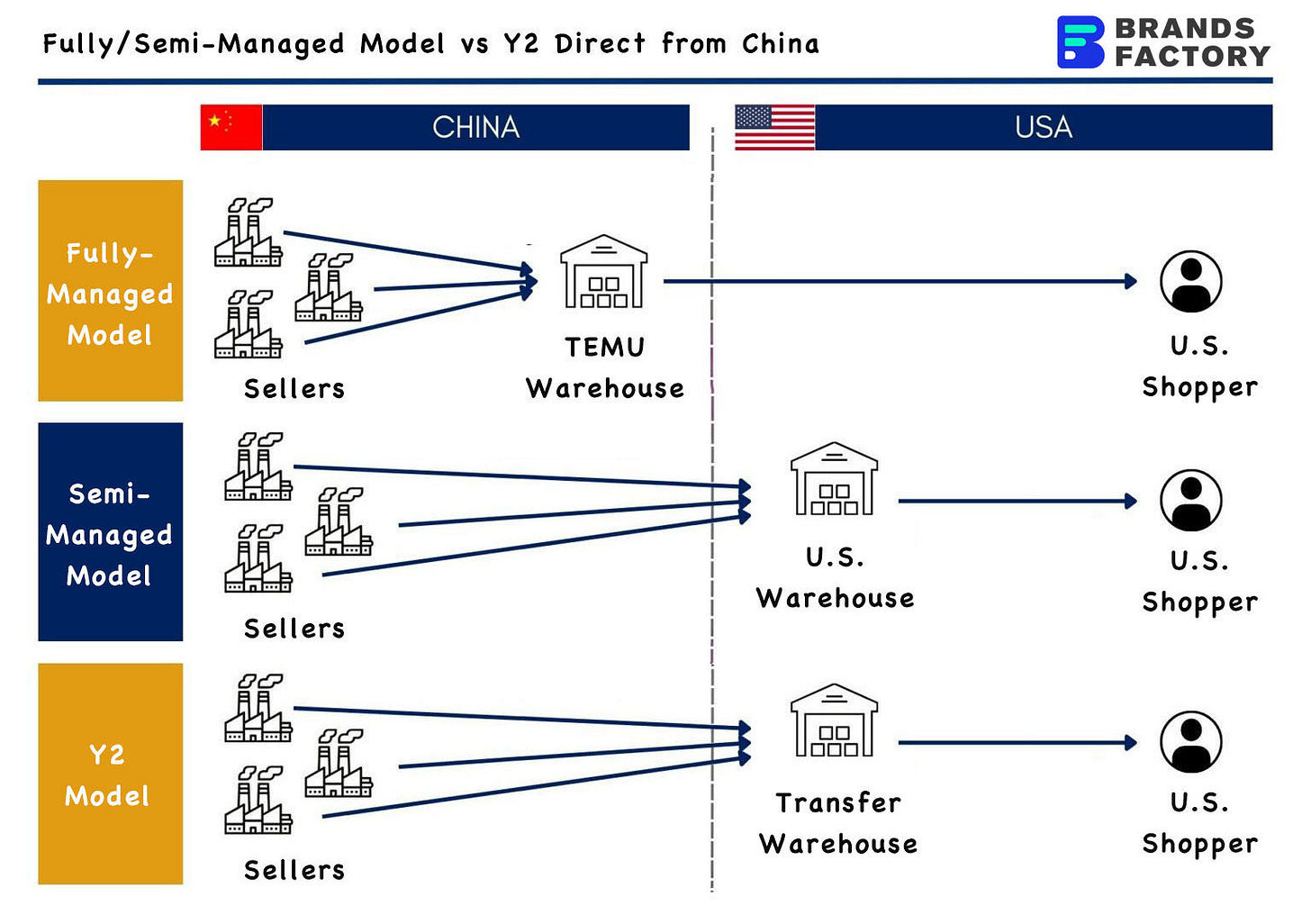

Previously, Temu's semi-managed model required merchants to first ship products from China to US-based warehouses. Or else, sellers would face penalties.

The new Y2 model streamlines this: After a US consumer orders, merchants can now directly ship from China. Goods are picked up domestically, air-shipped to the US, cleared through customs, transferred to a local courier pickup point, and finally delivered to the end customer.

From Fully-Managed Model to Y2

Temu introduced its fully-managed model when it entered the U.S. market in September 2022. Under this system, sellers were responsible solely for product offerings, while Temu took charge of logistics, customs clearance, warehousing, pricing, and marketing.

However, with the rising risks posed by high tariffs, the model became increasingly burdensome for Temu. As a result, starting in the second half of 2024, the company began scaling back its reliance on the fully-managed model, urging sellers to transition to the semi-managed alternative.

Temu launched its semi-managed model in 2024, responding to the U.S. decision to abolish the duty-free policy for low-value shipments. In this model, merchants take charge of pricing, inventory management, and some operational aspects, while Temu oversees logistics and warehousing.

This shift has reduced Temu's operational load and sped up delivery times, enhancing the customer experience. However, with escalating tariffs and frequent regulatory changes, many sellers are wary of stocking up, facing higher shipping costs and growing uncertainty.

The Y2 model was officially launched on April 27, 2025. Under this new framework, merchants remain responsible for the initial shipping, customs clearance, and final delivery, but unlike the semi-managed model, they no longer need to pre-stock inventory. Instead, they ship products only after receiving confirmed orders, reducing the risk tied to shifting policies.

Additionally, Y2 model listings will benefit from semi-managed traffic support, giving merchants a potential edge in visibility over those in fully-managed stores when selling the same products.

Temu's Tactics Towards Trade War

Facing skyrocketing tariffs and the end of de minimis exemption, Temu is changing the playbook for merchants.

Temu managers confirm the platform now allows each seller—including those from Hong Kong and mainland China—to operate up to three semi-managed stores with direct shipping from China.

Merchants can choose a 9-business-day fulfillment period, exempt from any penalties previously associated with delayed delivery.

These moves are part of broader strategic adjustments by Temu:

The platform has dramatically accelerated its shift of traffic away from fully-managed stores towards semi-managed ones, especially since April.

Fully-managed products pages have been significantly reduced, with Temu actively urging merchants to transition top-selling items into semi-managed stores.

Both existing and new merchants can now open dedicated "China-direct" stores, although new setups cannot mix inventory with existing stores. This initiative currently targets only the U.S. market.

Temu has introduced a new logistics option allowing merchants to select a 9-business-day shipping schedule, considerably longer than the original 2-day fulfillment period.

Merchants opting for this longer shipping timeframe will be marked accordingly in the system but won't face penalties. Temu mandates initial shipment to an overseas transfer warehouse, with final delivery handled via the platform's CALL labeling system.

From the consumer perspective, the only notable difference is longer waits for deliveries.

Costs Cut, Risk Shifted

Temu's merchants say the newly launched Y2 model closely mirrors Amazon's FBM (Fulfilled by Merchant) approach, letting sellers ship orders directly to consumers. It significantly eases sellers' cash constraints and lowers their risk when experimenting with new products—particularly helpful for seasonal or fast-moving categories.

From Temu's viewpoint, clinging to the old semi-managed model presents mounting overseas inventory risks due to volatile tariffs. Merchants' hesitation to stock U.S. warehouses can lead to shortages, while the fully-managed model burdens Temu with high warehousing and logistics costs, forcing price hikes that could alienate consumers.

With Y2, Temu pushes customs-clearance risks onto sellers, reducing its own warehousing and shipping expenses. Sellers dispatch products from China only after orders are confirmed, lowering their inventory financing burdens. This also allows Temu to scale by onboarding more sellers without overseas warehouse.

Analysts point out that Y2 slightly compromises Temu's delivery-speed advantage, but effectively maintains its core appeal—low prices.

Temu isn't alone in its strategic pivot. AliExpress, Shein, and even TikTok are reportedly adopting similar logistics tactics, shifting customs-clearance responsibilities onto merchants to mitigate tariff impacts.